Account Manager Controls Maintenance

The Ledger Manager Controls window contains ledger transaction integration and other settings and preferences that apply throughout the ledgers system.

Certain data items can only be changed and saved when you are the only user on the system. If you change a value the Save Changes and Revert to Saved buttons become enabled. A message will also appear at the bottom right to indicate either “Saving your changes can be made with other users on the system” or “Saving your changes requires Single-User operation”. In the later case you can only save changes if you are the only user on the system. If you are not, you will receive a message with the Multi-user Warning Message window.

|

Field |

Description |

|---|---|

|

Last modified |

Company and System Settings. Last modified date and time. {MCDFILE.MCDMOD date datetime 8} |

|

Button |

Action |

|---|---|

|

|

To print a report of all company details. Right-click for report destination. |

|

Revert to Saved |

To edit the company details. No other users can be operating on the data file. |

|

Save Changes |

To edit the company details. No other users can be operating on the data file. |

The window has 5 tab panes.

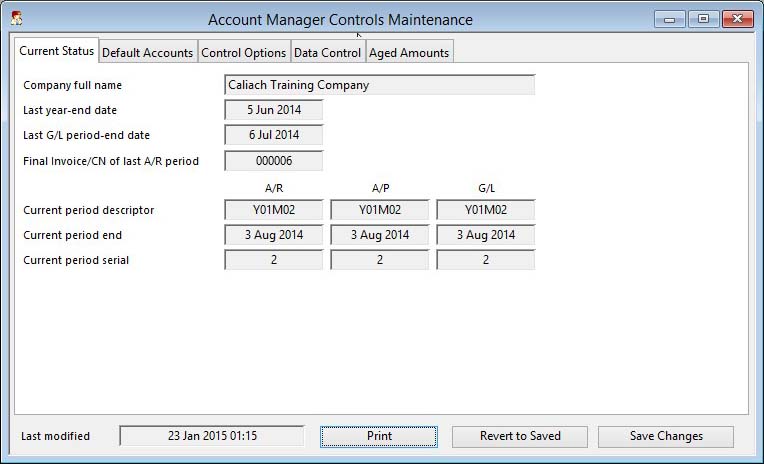

Current Status

Default Accounts

Control Options

Data Control

Aged Amounts

Current Status

This pane provides current status information on the ledgers system.

|

Field |

Description |

|---|---|

|

Company full name |

The licensed company name and extension. The first part of the name is controlled by your software license, the other can be set in the Company Details Maintenance window. |

|

Last year end date |

Company and System Settings. Accounts last year end date. {MCDFILE.MCDLYED date date1980} This is set during the Year End process (see the Ledgers Year-End Processing window.). |

|

Last G/L period-end date |

Company and System Settings. Accounts last period end date. {MCDFILE.MCDLPED date date1980} |

|

Final Invoice/CN of last A/R period |

Company and System Settings. Last invoice of last A/R period. {MCDFILE.MCDLINV char 6} |

|

Current period descriptors |

Descriptor of current A/R, A/P and G/L periods. |

|

Current period end |

The closing period date of the current A/R, A/P and G/L period. |

|

Current period serial |

Company and System Settings. Current A/R, A/P and G/L ledger period serial numbers. {MCDFILE.MCDRPER, MCDPPER and MCDACPE} |

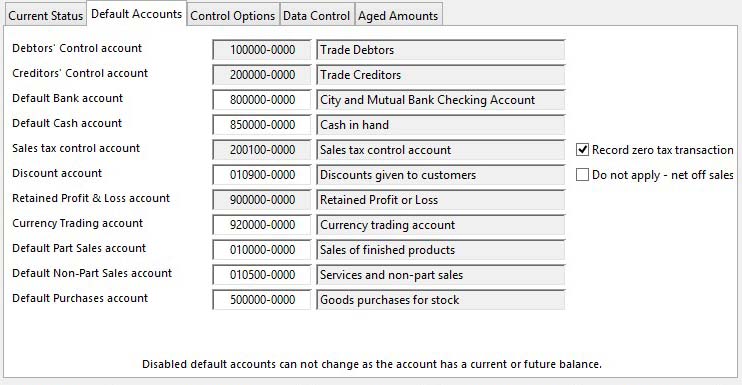

Default Accounts

|

Field |

Description |

|---|---|

|

Debtor’s control account |

Company and System Settings. Debtors control account. {MCDFILE.MCDDCTA char 10} The mandatory Debtor’s Control Account is used to record debtor transactions processed in the Accounts Receivable Ledger. This account must be assigned to a Balance Sheet report line. The mandatory Debtor’s Control Account is used to record debtor transactions processed in the Accounts Receivable Ledger. This account must be assigned to a Balance Sheet report line. |

|

Creditor’s control account |

Company and System Settings. Creditors control account. {MCDFILE.MCDCCTA char 10} This mandatory G/L account is used to record creditor transactions processed in the Accounts Payable Ledger. This account must be assigned to a Balance Sheet report line. This mandatory G/L account is used to record creditor transactions processed in the Accounts Payable Ledger. This account must be assigned to a Balance Sheet report line. |

|

Default Bank account |

Company and System Settings. Bank account 1. {MCDFILE.MCDBKA1 char 10} This is the default bank accounts and is used for cash transactions and payments from Customers and to Suppliers. This accounts must be assigned to a Balance Sheet report line and be a Bank type account. |

|

Default Cash account |

Company and System Settings. Cash account. {MCDFILE.MCDCASA char 10} The mandatory default Cash account is used as the default for Petty Cash and can be used for and payments from Customers and to Suppliers. This account must be assigned to a Balance Sheet report line and must be a Cash type account. |

|

Sales tax control account |

Company and System Settings. Tax control account. {MCDFILE.MCDTAXA char 10} The mandatory Sales Tax Control account is used for all sales tax postings. This account must be assigned to a Balance Sheet report line. |

|

Record zero tax transactions |

Company and System Settings. Record zero tax accrual transactions (needed for analysis of turnover values for zero taxes). {MCDFILE.MCDTAXZ boolean} This setting is provided to switch on the recording of zero tax transactions in the tax control accrual accounts (not just the default tax account). This is needed to provide turnover figures for zero-rated transactions in sales tax analysis. You should set this if you are working in a value-added tax environment. |

|

Discount account |

Company and System Settings. Discount account. {MCDFILE.MCDDISA char 10} The mandatory Discount Account is used to allocate all sales discounts. All invoiced items are recorded in their Sales Account in gross from (without taking account of discounts and tax). The discount control account holds transactions of all trading discounts. This must be a non-sales or purchase type account assigned to a P and L Statement report line. |

|

Do not apply – net off sales |

Company and System Settings. Prohibit discounts to control account flag. {MCDFILE.MCDISCF boolean} You can switch off this split of Gross and Discount so that the Sales Account is posted with the Net (I.E. Gross minus Discount). Check the Do not use checkbox to effect this. The Discount control account still must be defined, however, it will not be posted automatically when Invoices or Credit Notes are created. |

|

Retained Profit and Loss account |

Company and System Settings. Retained profit and loss account. {MCDFILE.MCDPROA char 10} The mandatory Retained P and L Account is used to allocate month end balancing totals. This account must be assigned to a Balance Sheet report line. |

|

Currency Trading account |

Company and System Settings. Currency change profit and loss account. {MCDFILE.MCDCURP char 10} The mandatory Currency Trading Account is used to post balances resulting from foreign currency changes. This account must be assigned to a P and L Statement report line. |

|

Default Part Sales account |

Company and System Settings. Default sales a/c for part numbered items. {MCDFILE.MCDSAPT char 10} The mandatory Default Part Sales Account is used during Invoice processing where the sales item has a part number, but has no Sales Account assigned to it. This must be a Sales type account assigned to a P and L Statement report line. |

|

Default Non-Part Sales account |

Company and System Settings. Default sales a/c for non-part numbered items. {MCDFILE.MCDSANP char 10} The mandatory Default Non-Part Sales Account is used during Invoice processing where the sales item has neither part number or Sales Account assigned to it. This must be a Sales type account assigned to a P and L Statement report line. |

|

Default Purchase account |

Company and System Settings. Default purchase a/c. {MCDFILE.MCDPUAC char 10} The mandatory Default Purchase Account is used as the default contra account during supplier invoice entry. This must be a Purchase type account assigned to a P and L Statement report line. |

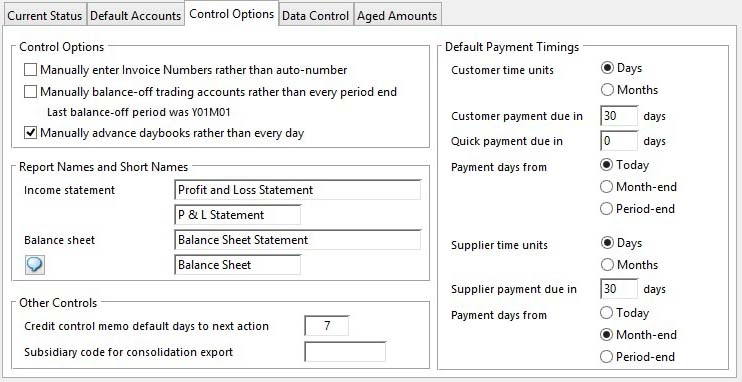

Control Options

Control Options

|

Field |

Description |

|---|---|

|

Manually enter Invoice Numbers rather than auto-number |

Company and System Settings. Manually enter Invoice Numbers rather than auto-number. {MCDFILE.MCDINVM boolean} This control option, if checked, will force the user to enter an Invoice Number in the New Invoice or Credit Note Number window whenever an Invoice or Credit Note is created by the system. The normal, unchecked, state causes the system to automatically generate a number and ensures that numbers are consecutive. This is the favoured approach by tax authorities and users choosing to manually enter Invoice Numbers should ensure that appropriate procedures are taken to prevent missing numbers. When the user manually enters an invoice number the standard invoice numbering serial value (in File — System Manager — Company Details — Document Numbers) is set to that number if it is larger than before. As a consequence automated invoice numbering can be resumed at any time after un-checking the control. However, gaps in the invoice number sequence will not be filled.

|

|

Manually balance-off trading accounts rather than every period end |

Company and System Settings. Balance-off Trading account at year-end NOT month-end. {MCDFILE.MCDYRPL boolean} Normally, with this option un-checked, when a General Ledger Month-End is processed all trading accounts are balanced-off and the net of all balancing is posted to the Retained Profit and Loss account. This means that you steadily accumulate retained profit throughout the year. However, the downside to this is that trading accounts have month-end balancing transactions for every month they contain activity. If this option is checked, you can control when month-end balancing-off takes place. A checkbox option in the Month-end control dialogue enables you to effectively control when profit is posted. The last period of balancing-off is shown below the checkbox control. |

|

Manually advance daybooks rather than every day |

Company and System Settings. Manual Daybook advance control flag. {MCDFILE.MCDAYCT boolean} This checkbox, if set, allows the user to control when the Daybook of each ledger is advanced. Normally, if un-checked, the Daybooks advance at the start of each new working day. As a consequence the contents of the Daybook is limited to the activity processed so far during the day you are viewing it. With this option checked, you can use the Daybook feature to review activity over a longer and irregular periods. |

Report Names and Short Names

|

Field |

Description |

|---|---|

|

|

The Ledgers Manager has control of the names of the two financial statements the system provides. The period Income statement (sometimes referred to as a Profit and Loss Statement) and the current Balance Sheet (sometimes referred to as a Financial statement). The Manager can name them in both long and short forms. The short forms are used on windows, messages, and buttons within the program, and should not contain ‘&’ or ” characters. |

|

Income statement long name |

Company and System Settings. P and L report name. {MCDFILE.MCDPLNM char 40} |

|

Income statement short name |

Company and System Settings. P and L report short name. {MCDFILE.MCDPLSN char 20} |

|

Balance sheet long name |

Company and System Settings. Balance sheet report name. {MCDFILE.MCDBSNM char 40} |

|

Balance sheet short name |

Company and System Settings. Balance sheet report short name. {MCDFILE.MCDBSSN char 20} |

Other Controls

|

Field |

Description |

|---|---|

|

Credit control memo default days to next action |

Company and System Settings. Credit control memo default days to next action. {MCDFILE.MCDTRCD integer} |

|

Subsidiary code for consolidation export |

Company and System Settings. Subsidiary code for consolidation export. {MCDFILE.MCDSUBC char 4} This is a 2 to 4 character code to identify this business as a subsidiary to a parent business. The program’s ledgers suite of functions provides for the export of G/L month-end results. The export file can then be transmitted to a parent business where the data can be imported into a consolidated general ledger. Each subsidiary must be given a unique subsidiary code to use this feature.

|

Default Payment Timings

|

Field |

Description |

|---|---|

|

|

You can choose to either apply payment Days or Months by selecting the appropriate radio button. You can also have the payment due date calculated either from the date of invoice (I.E. Today), from the end of the month of the invoice or the accounting period-end in which the invoice date occurs. Both customers and suppliers apply in the same way.

|

|

Customer time units in Days |

Company and System Settings. Customer payment months rather than days. {MCDFILE.MCDCUSM boolean} |

|

Customer time units in Months |

Company and System Settings. Customer payment months rather than days. {MCDFILE.MCDCUSM boolean} |

|

Customer payment due in period |

Company and System Settings. Default payment days for invoices. {MCDFILE.MCDTMDA number 0dpShortnum} |

|

Quick-payment due in period |

Company and System Settings. SO or Job default quick-payment days (or months) for invoices (0 = same as payment days). {MCDFILE.MCDQPDA number 0dpShortnum}

|

|

Customer payment days from Today |

Company and System Settings. Customer payment days from type (0=Today,1=Month-end,2=Period-end). {MCDFILE.MCDPAYT integer shortint} |

|

Customer payment days from Month-end |

Company and System Settings. Customer payment days from type (0=Today,1=Month-end,2=Period-end). {MCDFILE.MCDPAYT integer shortint} |

|

Customer payment days from Period-end |

Company and System Settings. Customer payment days from type (0=Today,1=Month-end,2=Period-end). {MCDFILE.MCDPAYT integer shortint} |

|

Supplier time units in Days |

Company and System Settings. Supplier payment months rather than days. {MCDFILE.MCDSUPM boolean} |

|

Supplier time units in Months |

Company and System Settings. Supplier payment months rather than days. {MCDFILE.MCDSUPM boolean} |

|

Supplier payment due in period |

Company and System Settings. Default payment days for suppliers. {MCDFILE.MCDSIDA number 0dpShortnum} |

|

Supplier payment days from Today |

Company and System Settings. Suppliers payment days from type (0=Today,1=Month-end,2=Period-end). {MCDFILE.MCDPAYS integer shortint} |

|

Supplier payment days from Month-end |

Company and System Settings. Suppliers payment days from type (0=Today,1=Month-end,2=Period-end). {MCDFILE.MCDPAYS integer shortint} |

|

Supplier payment days from Period-end |

Company and System Settings. Suppliers payment days from type (0=Today,1=Month-end,2=Period-end). {MCDFILE.MCDPAYS integer shortint} |

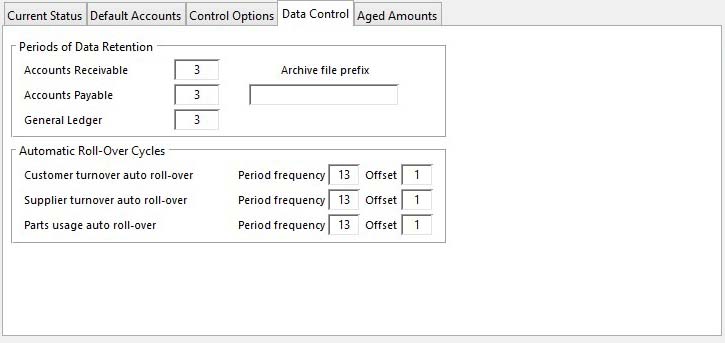

Data Control

Periods of Data Retention

The Ledger Manager can also set up the extent of transaction data retention. During month-end processing, historic transaction data is archived and then deleted. Accounts Payable and Receivable account and G/L Bank account transactions are only archived and deleted if they have been marked as cleared.

![]() WARNING: If you are using the system to provide Sales tax analysis for VAT returns the periods of data retention should exceed the tax return time period.

WARNING: If you are using the system to provide Sales tax analysis for VAT returns the periods of data retention should exceed the tax return time period.

|

Field |

Description |

|---|---|

|

Accounts Receivable |

Company and System Settings. Accounts Receivable retained periods. {MCDFILE.MCDARRP integer} |

|

Accounts Payable |

Company and System Settings. Accounts Payable retained periods. {MCDFILE.MCDAPRP integer} |

|

General Ledger |

Company and System Settings. General Ledger retained periods. {MCDFILE.MCDGLRP integer} |

|

Archive file prefix |

Company and System Settings. Accounts archive file prefix (used when multiple datafiles have ledgers). {MCDFILE.MCDAPRE char 15}

|

Automatic Roll-Over Cycles

It may be useful to link Customer dispatched net sales value, Supplier received purchase value and Parts usage quantity to Ledger month-end processing. This can be achieved by setting the frequency and offset of roll-over. Processing of all three are carried out automatically after processing A/R month-end. If you set any period frequency to 0, no automatic roll-over will take place. Otherwise, you must select a frequency for each and a period offset. For example, if you choose a frequency of 3 periods and an offset of 2, then roll-over will take place after A/R processing at the end of period numbers 2, 5, 8, 11, 14, etc.. In this way you can have master file roll-over sequences that are based on calendar cycles rather than financial cycles.

![]() NOTE: The period roll-over takes place at the time of A/R ledger month-end processing. This means that the values shown for customers, suppliers and parts are those up to the time of this processing. You should not assume that the values relate to ledger periods. Also understand that supplier turnover is calculated from purchase order values rather than supplier invoice values.

NOTE: The period roll-over takes place at the time of A/R ledger month-end processing. This means that the values shown for customers, suppliers and parts are those up to the time of this processing. You should not assume that the values relate to ledger periods. Also understand that supplier turnover is calculated from purchase order values rather than supplier invoice values.

|

Field |

Description |

|---|---|

|

Customer turnover auto roll-over |

Company and System Settings. Customer period auto-rollover NN00 (freq) + NN (offset). {MCDFILE.MCDCUSP number 0dpShortnum} |

|

Supplier turnover auto roll-over |

Company and System Settings. Supplier period auto-rollover NN00 (freq) + NN (offset). {MCDFILE.MCDSUPP number 0dpShortnum} |

|

Parts usage auto roll-over |

Company and System Settings. Part period auto-rollover NN00 (freq) + NN (offset). {MCDFILE.MCDPARP number 0dpShortnum} |

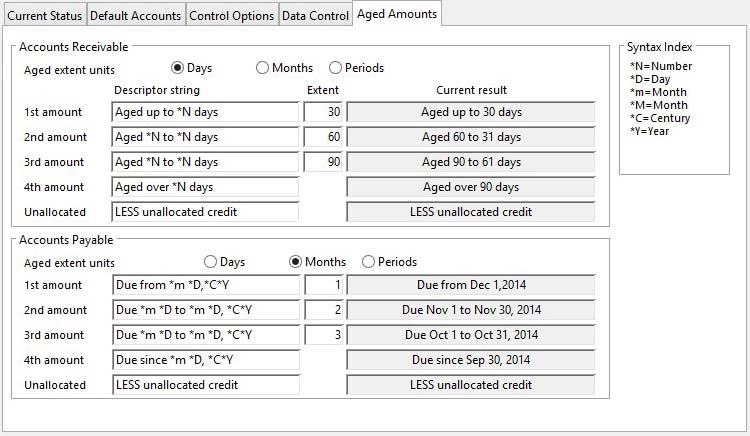

Aged Amounts

Aged debts and liabilities can be controlled by the Ledger Manager. You can independently apply controls to the Accounts Receivable and Accounts Payable ledgers. Aged amounts are shown in account list reviews, summary and review reports and on statements and ledger cards.

For each ledger you must decide which of the three alternative date control methods are applied. You can then enter the descriptors and the extent of the chosen method for each of the three ranges.

Special control characters can be used to format the descriptors:

|

Syntax |

Result |

|---|---|

|

*N |

substitutes the extent number |

|

*D |

substitutes the numeric day part of the applicable date |

|

*m |

substitutes the three character month part of the applicable date |

|

*M |

substitutes the numeric month part of the applicable date |

|

*C |

substitutes the numeric century part of the applicable date |

|

*Y |

substitutes the numeric year part of the applicable date |

The 5th descriptor covers the Unallocated Credit showing for the account.

During the edit process, if you tab in or out of a field or click on a descriptor, the resultant substituted text will be shown next to the edit boxes.

Days

You can apply control on the basis of the number of calendar days back from the current computer terminal date.

The applicable numbers and dates that substitute are as follows (where E1, E2, and E3 are the respective extents entered):

Descriptor 1st *N 2nd *N 1st date 2nd date 1st E1 0 Today's - E1 Today's 2nd E2 E1+1 Today's - E2 Today's - (E1 + 1) days 3rd E3 E2 Today's - E3 Today's - (E2 + 1) days 4th E3 E3 Today's - E2 days Blank

Months

You can apply control on the basis of the number of calendar months back from the first day of the current computer terminal date month. (E.g. if the current terminal date is March 18th 2002 and the extent is one month, the first aged period will be from 1st February 2002).

The applicable numbers and dates that substitute are as follows (where E1, E2, and E3 are the respective extents entered):

Descriptor 1st *N 2nd *N 1st date 2nd date

1st E1 0 First day of Today's

(current month - E1 months)

2nd E2 E2 First day of 1 day before first day of

(current month - E2 months) (current month - E1 months)

3rd E3 E3 First day of 1 day before first day of

(current month - E3 months) (current month - E2 months)

4th E3 E3 1 day before first day of Blank

(current month - E3 months)

Periods

You can apply control on the basis of the ledger calendar period end dates. The extent value determines how many period back the date range is from.

The applicable numbers and dates that substitute are as follows (where E1, E2, and E3 are the respective extents entered):

Descriptor 1st *N 2nd *N 1st date 2nd date

1st E1 0 Day after the end of Today's

E1 periods back

2nd E2 E2 Day after the end of The end of E1 periods back

E2 periods back

3rd E3 E3 Day after the end of The end of E2 periods back

E3 periods back

4th E3 E3 The end of E3 periods back Blank

![]() WARNING: Note that the first aged amount always covers transactions up to and including the current date of the user’s terminal internal clock. However, this means that any post-dated transactions are omitted from aged amounts.

WARNING: Note that the first aged amount always covers transactions up to and including the current date of the user’s terminal internal clock. However, this means that any post-dated transactions are omitted from aged amounts.

Compiled in Program Version 5.10. Help data last modified 14 Sep 2017 04:56:00.00. Class wAcManager last modified 30 Mar 2018 07:11:38.