Product Costing

After a Product Costing routine is run an Alert Message dialogue box will be presented. A scrollable field is available showing messages generated by the processing. The message text can be printed.

|

Button |

Action |

|---|---|

|

Process |

Having made your function and part range selection, this processes the costing operation. |

Roll-up assembly current costs

This process will operate on the range of parts selected, and in the reverse order of BoM lowest level number. I.E. starting at the maximum level and completing all zeros last.

If you want a variance report, enter the percent variance which parts will be listed on the report. If you leave it zero, no report is produced.

This function will re-calculate current costs using the following logic:

|

Condition |

Algorithm |

|---|---|

|

Part Type = B (buy) |

If there is no Purchase History, the material cost will be left unchanged while labour, outwork and overhead costs are set to zero. In this case, the Alert Message lists all parts where there is no current material cost. If there is Purchase History, the material cost will be calculated from it while labour, outwork and overhead costs are set to zero (See Material Costing Method below) |

|

Part Type = P (PO Kit) |

The calculation of the part will be the same as above. However, after calculation the component kit items of the assembly are all re-costed on the basis of their existing ratios of cost. I.E. The cost of components will be set to make the total component costs equal to the parent cost, distributing it on the basis of the current distribution of costs. In this cost distribution the components involved will be those with the For supplies of the part MRP will order PO Kits part attribute checked. Those with it unchecked will be costed in the normal way with direct reference to purchase history. |

|

Part Type not = B (buy) and there are BoM components for the part |

The material, labour, outwork and overhead costs are accumulated from the part’s immediate (single level) bill of materials. For the this-level value, only those parts in the BoM that are not themselves parents are accumulated. |

|

Part Type = O (outwork assembly) |

If there is Purchase History, the this-level outwork cost will be calculated from it and added to the current outwork cost calculated above (See Material Costing Method below) |

|

Part Types A (automatic), M (make) or N (non-stock) and the part has a process route |

The labour, outwork and overhead costs are calculated from the process route operation times and work centre cost rates. Alert Message lists all Parts with Re-Order Quantities less than 1. |

This process is not true multi-level cost role-up unless all parts are included in the selection, by leaving all selection fields blank.

![]() WARNING: This routine can not be run when the BoM Lowest Level Numbers automatically adjusted control is NOT checked in the File — System Manager — System Preferences. It can only be set by running Re-organise BoM File in the “Advanced” “Re-set Data Files” suite of functions.

WARNING: This routine can not be run when the BoM Lowest Level Numbers automatically adjusted control is NOT checked in the File — System Manager — System Preferences. It can only be set by running Re-organise BoM File in the “Advanced” “Re-set Data Files” suite of functions.

Material Costing Method

There are four optional methods of Material Costing (the costing of items purchased from suppliers). The option which will be used is chosen in the “System Manager” “Company Details”.

|

Method |

Explanation |

|---|---|

|

Last Price Paid |

Takes the unit cost in the last purchase history record. |

|

First In First Out FIFO |

Takes account of the current inventory physical quantity and calculates the current costs based on the preceding history of purchases assuming that receipts into inventory are consumed in the order they are received. |

|

Last In First Out LIFO |

Uses purchase history in the same way as FIFO but assumes that newest receipts are consumed first. |

|

Average of History |

Uses all purchase history records for the part and calculates a weighted average cost for the part. |

Receiving overhead cost

There are two default receiving overhead rates set in the “System Manager” “Company Details” function. A Goods (PO) receiving overhead (burden) rate applies to purchase items including outwork assemblies. A Work Order receiving (completion) overhead rate applies to parts costed on the basis that they are manufactured through a WO. If the part has a non-zero individual rate (PTMROVR), then this will apply rather than this default rate. If PTMPOVR is negative, the overhead rate will be zero. In the case of a purchased part, the Receiving Overhead Cost is calculated from the Goods received overhead rate times the prime (material) cost. In the case of a manufactured item, it is calculated from the WO received overhead rate times the “This-level cost” of the assembly (it is not applied to rolled up sub-assembly costs). The receiving overhead is rolled up into the material cost element of any higher assemblies. Thus where there is a recorded Receiving Overhead Cost it only relates to the immediate material and, if any, processing costs. Any lower-level receiving overhead costs will be incorporated with the accumulated material cost element.

Minimum Order quantity

The Minimum Order Quantity is used to calculate the component of Labour and Overhead cost attributable to process route operation Setup Time. If the Minimum Order Quantity is less than, or equal to, 1, the Setup Time cost is applied in full to the part unit cost. Inappropriate Minimum Order Quantities will have stock value implications.

Yield

The Part yield in lost units per batch rather than percent rate system preference varies the units in which the part yield value is seen by the costing system. If this preference is set the yield rate for costing purposes is the Re-order Quantity minus the Yield Loss Units divided by the Re-order Quantity expressed as a percent. This means that the effective yield rate varies with part re-order quantity.

Yield rate is a value in percent to 2 places of decimal that can optionally have an effect on costing and MRP recommended demand. It is the percentage of an ordered quantity that will be, on average, received into stock. The normal rate is 100.00% and with this rate it has no effect on costing or planning.

For a non-normal yield to have an effect on costing the Part yield is used when calculating costs System Preference must be set.

For a purchased part, the cost of the part will be calculated as the actual cost divided by the yield rate. This has the effect of uplifting the cost and can be seen as taking into account losses in the transport, quality inspection or other receiving processes.

For parts with a BoM that are manufactured or outwork assemblies, the yield will similarly uplift the cost in assuming that only the yield rate of finished part will be subsequent useful inventory, even though the full kit quantity and process cost was consumed.

Roll-over current to standard costs

This process simply copies the current cost elements into the standard cost elements.

It is in general used to fix the standard costs to the current costs at a particular point of time, typically year end. Standard costs can then be used as a base value, against which cost performance throughout the year can be judged.

Messages are listed for the following conditions:

- Parts which have a zero total standard cost.

- Parts where there is more than a 5% change in standard cost.

Adjust selling price by %

This process enables you to increase or decrease part Selling Prices by a fixed proportion of that currently existing, rounded to two places of decimal. It also applies to any currency prices. All type ‘N’ (Non-stock) parts are ignored by this process.

Messages are listed for the following conditions:

- Parts that have a zero Selling Price.

Apply sales mark-up or margin to cost

This process makes use of the Mark-up or Gross Margin set for each part and recalculates the Selling Price from its costs. You are offered the option of using Standard Costs or Current Costs.

All type ‘N’ (Non-stock) parts are ignored by this process. You have a “System Manager” “System Preferences” choice of Mark-up or Gross Margin. For Mark-up, the routine makes the Selling Price = Total Cost * (100 + Auto price mark-up) / 100. For Gross Margin, the routine makes the Selling Price = Total Cost * 100 divided by (100 – Gross Margin) where Gross margin is forced to be greater than 99.0%. If there was an existing local currency Selling Price, any currency prices will be adjusted to match the new selling price with the same notional exchange rate as applied before.

Messages are listed for the following conditions:

- Parts that had a zero selling price.

- Parts that have a zero sales mark-up.

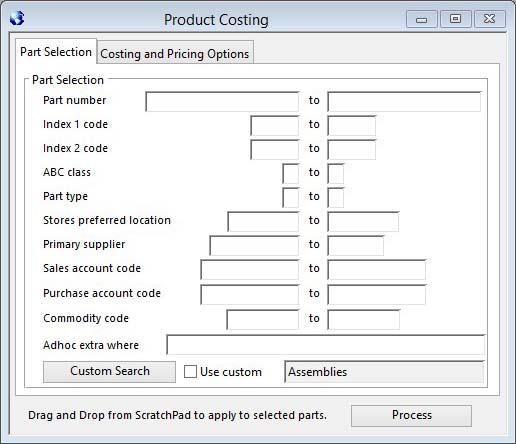

The window has 2 tab panes.

Part Selection

Costing and Pricing Options

Part Selection

You have three options for the selection of part records that operations will be applied to:

- You can use the selection ranges to directly select parts that match the criteria you enter. Those parts will then be subject to the change.

- You can transfer the contents of the Parts ScratchPad and individually select those parts you wish to apply operations to.

- You can select a number of Parts ScratchPad lines and drag and drop them onto the Process button for only the selected parts to be operated on.

![]() NOTE: This window contains fields introduced with version 5 that enable additional search (and sometimes sort controls), such as Adhoc extra where. For more help on their use and examples see the Client-Server SQL Introduction help.

NOTE: This window contains fields introduced with version 5 that enable additional search (and sometimes sort controls), such as Adhoc extra where. For more help on their use and examples see the Client-Server SQL Introduction help.

|

Field |

Description |

|---|---|

|

Selection range |

Enter a selection in the Part Selection subwindow. |

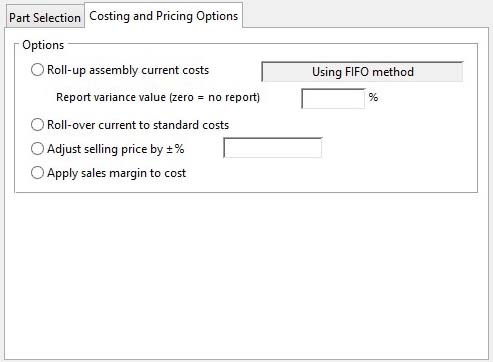

Costing and Pricing Options

Choose from this pane the part costing or pricing option you wish to process.

|

Field |

Description |

|---|---|

|

Roll-up assembly current costs |

Choose this option to roll-up costs from history, BoMs and Routes. This calculates costs from purchase history, BoM, Process Routes and Work Centre rates. |

|

Valuation method |

Company and System Settings. Stock valuation method (0=Last,1=FIFO,2=LIFO,3=Average). {MCDFILE.MCDVALU integer shortint} |

|

Report variance value % |

Enter a percent value to print a report or changes made that exceed the variance value. |

|

Roll-over current to standard costs |

Choose this option to roll-over current costs into standard costs for the selection of parts entered. It is normally only undertaken at one point in your financial cycle. |

|

Apply sales mark-up or margin to cost |

Choose this option to re-calculate, for the selected range of parts, sales prices based on their cost and their auto-price mark-up or gross margin. |

|

Percent change to apply |

Enter a positive or negative percent value that will apply when increasing or decreasing the selected part’s selling price. |

|

Adjust selling price by plus or minus % |

Choose this option to change the selected parts selling prices by the entered percentage rate. |

| See also: – |

Compiled in Program Version 5.10. Help data last modified 10 Feb 2017 00:38:00.00. Class wCost last modified 7 Apr 2018 03:53:15.