General Ledger Journals

A Journal is a set of transactions where an amount from one G/L account is distributed to one or more other G/L accounts. In all other G/L transactions there is a specific Contra transaction to ensure balance is maintained. Account balance is maintained in a Journal transaction but by distribution across several accounts.

Each Journal is given a serial number automatically when posted. Journal serial numbers are maintained in the same way as Invoice numbers, etc. One transaction is created for each journal account entry and they are given ‘Jnnnnnn’ as the Contra field value, where nnnnnn is the journal number.

Journal Options

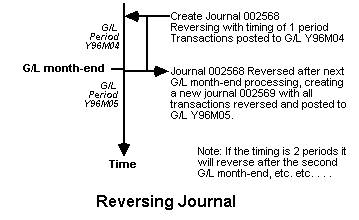

Reversing: A Journal can be set to Reverse in the a future General Ledger period. The point at which it is reversed can be controlled with the ‘After A/R Month-end’ option checkbox. The future period of reversal is controlled by the period timing. Entering a 3 in this field will lead the journal to be reversed 3 periods later (e.g. If the journal is created in January with period timing of 3, it will be reversed in April.)

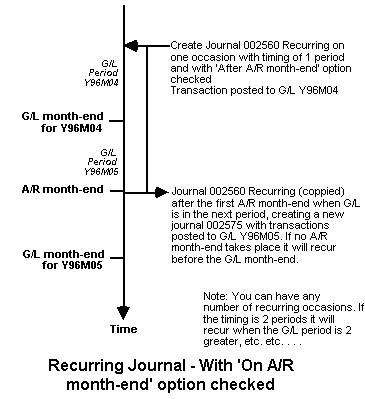

Recurring: A Journal can also be set to Recur (repeat) automatically any number of occasions in future General Ledger periods. The cycle periods of recurring journals can be set. It must be at least 1. The point in the period at which it is repeated can be controlled with the ‘After A/R Month-end’ option checkbox.

You can, if you have an accounting reason to do so, have a journal set to both reverse and recur. In this case the Journal will recur in the normal way and then reverse as you would expect from a manually entered reversing journal.

|

Transaction process |

G/L Journal |

Type 002 |

|---|---|---|

|

Debit |

Gross amount only |

to G/L selected accounts |

|

Credit |

Gross amount only |

to G/L selected accounts |

|

|

…. continued with as many credits and debits as required. |

|

|

|

Transactions can be posted only when the sum of all transactions equals zero. |

|

When a journal transaction involves the Tax Control Account the Tax Transaction Details window will be brought forward to choose a tax class.

Common Variables and Buttons

|

Field |

Description |

|---|---|

|

Journal Number |

Journals. Journal number. {JOUFILE.JOUJONO char 6} |

|

Journal title |

Journals. Title. {JOUFILE.JOUNAME char 40} |

|

Button |

Action |

|---|---|

|

New Journal |

Click to create a new blank Journal. |

|

Review a Previous |

To review a previously created Journal. Enter the Journal number, confirming with an OK. You may subsequently copy the Journal to a new one. You can review a Journal by clicking on this button, entering a Journal number, pressing the tab. |

|

Print Journals |

To print a selection of previously recorded Journals. You will be presented with the Print Journal Report Selection window. |

|

Copy This Journal |

To duplicate the currently selected Journal. You can then change any details and post as a new Journal. |

The window has 2 tab panes.

Journal Details

Journal Transactions

Journal Details

Journal selection an details

|

Field |

Description |

|---|---|

|

Date |

Ledger Transactions. Date of transaction. {TRAFILE.TRADATE date date1980} |

|

Posting period |

Select alternative for posting in a future G/L period. See Retrospective Journals at the end of this topic for posting into past closed periods. |

|

Comment |

Journals. Comments. {JOUFILE.JOUCOMM char 10000000} |

|

Reversing options |

Journals. Reversing control (0=normal, 1=reversing, 2=reversed). {JOUFILE.JOUREV integer shortint} |

|

Reversed from |

Journals. Original journal number for auto-created journals. {JOUFILE.JOUSOUR char 6} |

|

Recurring |

Journals. Recurring period cycle (1=every period, 2=every 2nd period, etc). {JOUFILE.JOURECP integer shortint} |

|

Reverse or recur period cycles |

Journals. Recurring future occasions. {JOUFILE.JOURECF integer} |

|

Reverse or Recur after A/R month-end |

Journals. Reverse or Recurring after A/R month-end flag. {JOUFILE.JOUREVR boolean} |

|

Next action period |

Journals. Next period for future auto-action. {JOUFILE.JOUNEXT number 0dpShortnum} |

|

Button |

Action |

|---|---|

|

Revert |

To revert any changes to the previously saved version. |

|

Save |

To save the changes you have made to the data file. |

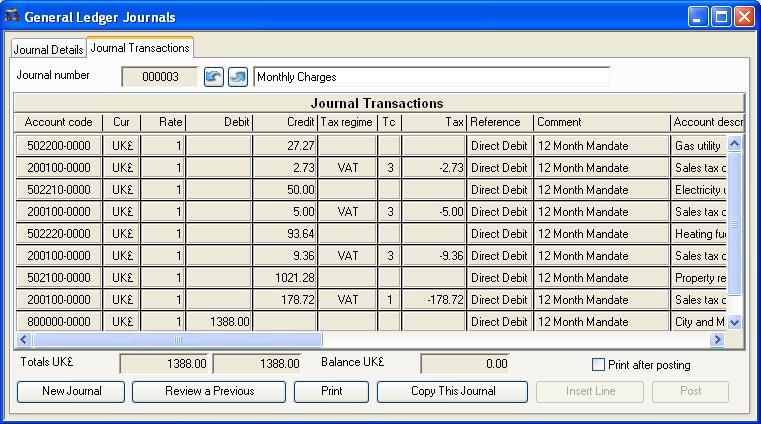

Journal Transactions

The selected journal’s account transactions.

|

Field |

Description |

|---|---|

|

Account code |

Ledger Transactions. Account code. {TRAFILE.TRAACCO char 10}. |

|

Currency |

Ledger Transactions. Currency code. {TRAFILE.TRACURR char 3} |

|

Rate |

Ledger Transactions. Currency exchange rate. {TRAFILE.TRARATE number float} |

|

Debit value |

Enter the debit value inclusive of sales tax if applicable. |

|

Credit value |

Enter the credit value inclusive of sales tax if applicable. |

|

Tax regime and class |

Tax Regimes. Tax regime code. {TAMFILE.TAMCODE char 6} and Tax Class Definitions. Tax class (related to TARCLAS). {TACFILE.TACCLAS char 1}. Select the tax regime appropriate for the supplier and the class appropriate to the goods being purchased. Select from the dropdown lists. (See the Tax Maintenance window for details of the tax system.) The tax regime applied by default is that of the default supplier regime set in the company details. The tax class applied by default is that of the default purchase non-part class set in the company details. |

|

Sales tax amount |

The value of sales tax (positive for debits), if any. |

|

Document reference |

Ledger Transactions. Document reference. {TRAFILE.TRADOCR char 15} NOTE: Document Reference values can not be between “XX-000000” and “XX-999999” where XX is either ASS, CA, CH, CR or IN, as these are reserved for the system. |

|

Comment |

Ledger Transactions. Comments on transaction. {TRAFILE.TRACOMM char 30} |

|

G/L account description |

General Ledger Accounts. Description. {GLAFILE.GLADESC char 40} |

|

Total debits |

Shows the total debits in local currency, inclusive of tax, of all items you have entered on the list. |

|

Total credits |

Shows the total credits in local currency, inclusive of tax, of all items you have entered on the list. |

|

Journal balance |

Shows the journal debit balance in local currency. |

|

Button |

Action |

|---|---|

|

Insert Line |

With the cursor in a list line, click to insert a fresh line and shift others down one line. |

|

Post |

Having prepared the Journal lines onto the list, this will confirm the Journal to file. Posting is only possible if the Journal balance is zero.

|

Make the entries in the grid. To add an entry to the end, tab out of the last line. To remove a line, blank the account code.

Retrospective Journals (After Month-end)

There are occasions when it is appropriate to post adjustments to closed G/L periods. Typically at the end of a financial year, before the auditors descend on you, you want to close of the final month-end. However, after the auditors have finalised your accounts for the year their adjustments need to be applied retrospectively to the final month of the year. This process of ‘auditor adjustments’ is known in the program as Retrospective Journals.

Normally, when creating a journal you will not be able to select a period for that journal prior to the current G/L period. However, an Option is available that can be set in File — System Manager — Privileges and Settings then System tab and Options tab. The optAcRetroJouUsers option can be set to a comma-separated list of users who are permitted to carry out Retrospective Journals. Those users are then permitted to select a G/L period prior to the current G/L period but later than the final period of last year. I.E. they will be permitted to apply the journal to any period in the current financial year. You can also set the date to any day after the last year-end. Normally you can only apply a date subsequent to the last month-end date.

When posting a Retrospective Journal the system records the journal and its transactions in the normal way. However, it then goes on to carry out the following extra adjustments:

- It adjusts the period-end history for the transaction account and period.

- For asset (balance sheet) accounts, it adjusts any subsequent closed period history to ‘roll-forward’ the changed account balance.

- For trading (P and L) accounts, it seeks to adjust the first balancing off period transaction and for that period adjusts the retained profit account. Where specific account-period transactions do not exist, they are created.

- Appropriate G/L balances and turnover figures are adjusted.

![]() WARNING: Great care must be taken when using this feature as a number of assumptions are made which you should be aware of:

WARNING: Great care must be taken when using this feature as a number of assumptions are made which you should be aware of:

- Any retained profit and loss adjustments are made to the current retained profit and loss account set in Ledgers — Ledger Manager — Control Settings – Defaults tab. If you have the practise of changing this account default after year-end, you should temporarily change it back before posting a retrospective journal.

- If accounts are included that did not exist at the time the period was closed, for trading accounts their history may have missing records, which in terms of operation of the system and reporting is inconsequential.

- When you view the audit trail of transactions sorted by transaction id you may see additional month-end transactions. This will appear odd, but is a consequence of including trading account transactions to accounts that had no previous activity for that period.

- The journal number given is the next number in just the same way as a normal journal. This may appear out-of-sequence when viewed from a period or date perspective.

| See also: – |

Compiled in Program Version 5.10. Help data last modified 4 Jun 2012 04:47:00.00. Class wAcGlJournal last modified 10 Oct 2017 11:47:52.