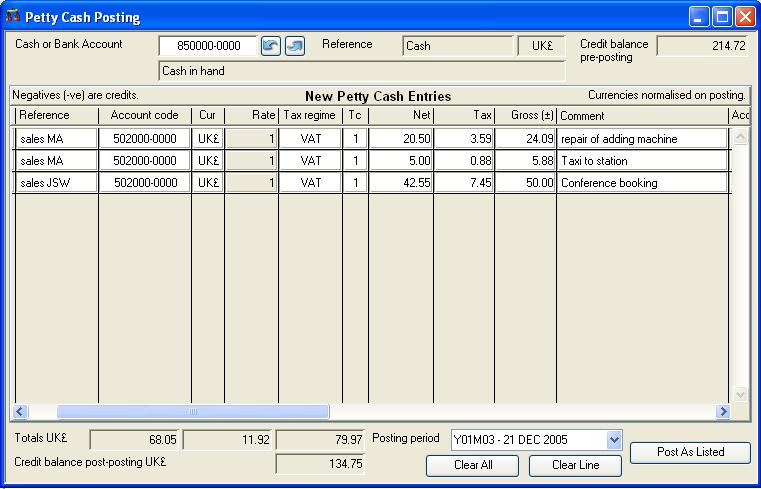

Petty Cash Posting

Cash or direct Bank transactions can be processed using this function. Typically you can use it for recording petty cash or employee expense claims.

Processing can be carried out on any Cash type or Bank type G/L account. The arrow buttons or drag and drop from the ScratchPad enables you to select a Cash or Bank type account. All values at the bottom of the window are shown in the selected account’s currency.

You should build a list of transactions by tabbing out of the last line in the grid list, assigning each payment to a purchase type G/L account. You can enter cash deposits from a bank account with negative amounts, but only if you are processing in a Cash type account. When the list is prepared it can be changed using the Clear All or Clear Line buttons. Once you are satisfied with all entries on the list, post them by clicking on the Post as Listed button.

|

Field |

Description |

|---|---|

|

Cash or Bank Account |

General Ledger Accounts. Account code. {GLAFILE.GLACODE char 10} |

|

Reference |

General Ledger Accounts. User reference. {GLAFILE.GLAUSER char 10} |

|

Account currency |

General Ledger Accounts. Currency of the account. {GLAFILE.GLACUR char 3} |

|

Credit balance pre-posting |

Shows the account credit balance for Petty Cash prior to posting any entries you are currently making. Indicates cash-on-hand. |

|

Description |

General Ledger Accounts. Description. {GLAFILE.GLADESC char 40} |

|

Grid list |

Make the entries in the grid. To add an entry, tab out of the last line. Transactions, not in the currency of the Cash or Bank Account will be converted on posting. |

|

Date |

Ledger Transactions. Date of transaction. {TRAFILE.TRADATE date date1980} |

|

Reference |

Ledger Transactions. Document reference. {TRAFILE.TRADOCR char 15} NOTE: Document Reference values can not be between “XX-000000” and “XX-999999” where XX is either ASS, CA, CH, CR or IN, as these are reserved for the system. |

|

Account code |

General Ledger Accounts. Account code. {GLAFILE.GLACODE char 10} |

|

Tax regime and class |

Tax Regimes. Tax regime code. {TAMFILE.TAMCODE char 6} and Tax Class Definitions. Tax class (related to TARCLAS). {TACFILE.TACCLAS char 1}. Select the tax regime appropriate for the supplier and the class appropriate to the goods being purchased. Select from the dropdown lists. (See the Tax Maintenance window for details of the tax system.) The tax regime applied by default is that of the default supplier regime set in the company details. The tax class applied by default is that of the default purchase non-part class set in the company details. |

|

Currency |

Ledger Transactions. Currency code. {TRAFILE.TRACURR char 3} You can change the currency to help with expense claims, however on posting the transaction will be converted to the currency of the posting account. |

|

Exchange rate |

Ledger Transactions. Currency exchange rate. {TRAFILE.TRARATE number float} |

|

Net value |

Ledger Transactions. Gross value in currency before tax. {TRAFILE.TRAGROSF number 2dp} |

|

Tax value |

Ledger Transactions. Tax value in currency. {TRAFILE.TRATAXF number 2dp} |

|

Gross value |

The total value including tax. If this is negative it will credit the account. |

|

Comment |

Ledger Transactions. Comments on transaction. {TRAFILE.TRACOMM char 30} |

|

Account description |

General Ledger Accounts. Description. {GLAFILE.GLADESC char 40} |

|

Total net |

Shows the total in account currency, exclusive of tax, of all items you have entered on the list. The account will be credited if this value is negative. |

|

Total tax |

The total tax in account currency of all Petty Cash transactions you have entered. |

|

Total gross |

Shows the total in account currency, inclusive of tax, of all items you have entered on the list. The account will be credited if this value is negative. |

|

Credit balance post-posting |

The resultant cash that will be remaining in the account after posting the entries you have made. |

|

Period for posting |

Select an alternative to post in a future G/L period. |

|

Button |

Action |

|---|---|

|

Clear All |

Click here to clear the whole list and start again. |

|

Clear Line |

With the cursor in a line you want removed, Click here to remove the line. |

|

Post As Listed |

After you are satisfied you have entered all the transactions you wish to make, use this button to post them to file. |

|

Transaction process |

Petty Cash Payment |

Type 035 |

|---|---|---|

|

Credit |

Gross + Tax |

to G/L cash or bank a/c |

|

Debit |

Gross only |

to G/L posting a/c |

|

Debit |

Tax only |

to G/L tax control a/c(s) |

|

|

or if a credit |

|

|

Debit |

Gross only |

to G/L cash a/c |

|

Credit |

Gross only |

to G/L bank a/c |

Compiled in Program Version 5.10. Help data last modified 4 Jun 2012 04:47:00.00. Class wAcPettycash last modified 25 Oct 2016 09:39:55.