Cash Book Transaction Posting

A cash book transaction (type 37) is a set of one or more direct postings to G/L accounts balanced by a single payment (or cash receipt) from a selected bank or cash account. It has a similar effect to an A/P Invoice posting with the Pay Now option, however in this case no supplier is involved. It also has some of the characteristics of a Journal in that it generates transactions only within the G/L and is sequentially numbered.

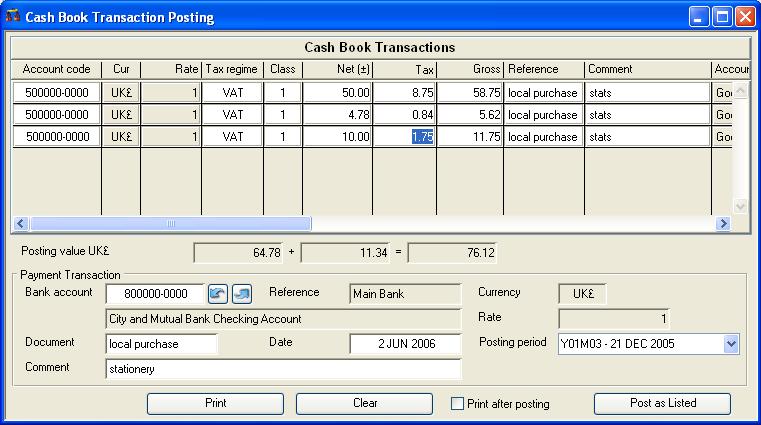

The Cash Book Transaction window consists of an enterable list which you fill out much like a spreadsheet. First enter a G/L posting account and tab to enter a tax class and amount, etc. On tabbing out of the Comment column, a new line will be added in which another posting can be entered. Any line with zero gross value will be removed automatically before posting.

Make the entries in the grid. To add an entry to the end, tab out of the last line. To remove a line, blank the account code.

You can enter any number of accounts for posting and they can be in mixed currencies. The totals at the bottom are respectively the total net posting, the total tax that will be debited to the tax control account(s) and the gross amount that will be credited to the bank or cash account you select.

When you have finished preparing the cash book transaction, click on the Post as Listed button. The transaction will be posted and you will be offered the opportunity to print a record of it.

On posting the system generates a serial number for the cash book transaction and stamps the contra field of each transaction with Cnnnnnn, where nnnnnn is the cash book transaction number.

|

Transaction process |

Cash Book Transaction |

Type 037 |

|---|---|---|

|

Debit |

Net posting(s) |

to G/L posting account(s) |

|

Debit |

Tax amount (if any) |

to G/L tax control a/c(s) |

|

Credit |

Gross total amount |

to G/L bank or cash a/c |

|

Field |

Description |

|---|---|

|

Account code |

Ledger Transactions. Account code. {TRAFILE.TRAACCO char 10} |

|

Currency |

Ledger Transactions. Currency code. {TRAFILE.TRACURR char 3} |

|

Exchange rate |

Ledger Transactions. Currency exchange rate. {TRAFILE.TRARATE number float} |

|

Tax regime and class |

Tax Regimes. Tax regime code. {TAMFILE.TAMCODE char 6} and Tax Class Definitions. Tax class (related to TARCLAS). {TACFILE.TACCLAS char 1}. Select the tax regime appropriate for the supplier and the class appropriate to the goods being purchased. Select from the dropdown lists. (See the Tax Maintenance window for details of the tax system.) The tax regime applied by default is that of the default supplier regime set in the company details. The tax class applied by default is that of the default purchase non-part class set in the company details. |

|

Net value + or – |

Ledger Transactions. Gross amount in currency debited (-ve credited) to account. {TRAFILE.TRAGROSF number2dp} |

|

Tax amount |

Ledger Transactions. Tax amount in currency on net purchases (-ve on sales). {TRAFILE.TRATAXF number2dp} |

|

Gross amount |

The sum of the Net and Tax value. |

|

Document reference |

Ledger Transactions. Document reference. {TRAFILE.TRADOCR char 15} NOTE: Document Reference values can not be between “XX-000000” and “XX-999999” where XX is either ASS, CA, CH, CR or IN, as these are reserved for the system. |

|

Comments |

Ledger Transactions. Comments on transaction. {TRAFILE.TRACOMM char 30} |

|

G/L account description |

General Ledger Accounts. Description. {GLAFILE.GLADESC char 40} |

|

Total net |

Total net value (without tax) in the indicated currency of the bank account. |

|

Total tax |

Total tax value in the indicated currency of the bank account. |

|

Total gross |

Total gross value (with tax) in the indicated currency of the bank account. It is this value that will be posted to the bank account |

|

|

Payment Transaction |

|

Bank account |

General Ledger Accounts. Account code. {GLAFILE.GLACODE char 10} |

|

User reference |

General Ledger Accounts. User reference. {GLAFILE.GLAUSER char 10} |

|

Currency |

General Ledger Accounts. Currency of the account. {GLAFILE.GLACUR char 3} |

|

Account description |

General Ledger Accounts. Description. {GLAFILE.GLADESC char 40} |

|

Exchange rate |

General Ledger Accounts. Currency rate. {GLAFILE.GLARATE number float} |

|

Document reference |

Ledger Transactions. Document reference. {TRAFILE.TRADOCR char 15} |

|

Date |

Ledger Transactions. Date of transaction. {TRAFILE.TRADATE date date1980} |

|

Posting period |

Select alternative for posting in a future G/L period. [$ctask.tEnv.$Fld(‘TRAFILE’,’TRAPERN’)] |

|

Comments |

Ledger Transactions. Comments on transaction. {TRAFILE.TRACOMM char 30} |

|

Button |

Action |

|---|---|

|

|

Click to print one or a range of cash book transactions. You will be presented with the Cashbook Print Selection window. |

|

Clear |

Click to clear the list and start again. |

|

Post as Listed |

Having prepared the transaction lines and payment entries, click to post the Cash Book transactions to file. |

| See also: – |

Compiled in Program Version 5.10. Help data last modified 4 Jun 2012 04:47:00.00. Class wAcGlCash last modified 10 Oct 2017 11:47:50.