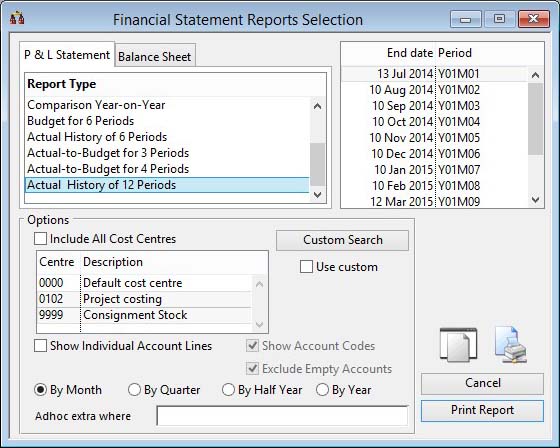

Financial Statement Reports Selection

You can choose to run the report for all cost centres or select a limited range of them to extract data from.

The Show Individual Account Lines option provides a full listing for all accounts. The normal prints the report in a consolidated manner, where accounts are consolidated into their respective report lines.

|

Field |

Description |

|---|---|

|

Report list |

Select a report type. |

|

Period list |

Select the period for the report or the final period of the report. |

|

Include All Cost Centres |

Select this option to include accounts from all cost centres. |

|

Cost centre list |

Cost Centre list. For reports restricted to accounts with certain cost centres, select those to be included. |

|

Show Individual Account Lines |

Select this option to show the individual account details of each group on the report. Otherwise a consolidated summary where accounts assigned to report headings are summed onto the one line. |

|

Show Account Codes |

Select this option to show account codes as will as descriptions. |

|

Exclude Empty Accounts |

Select this option to exclude accounts with zero values. This does not apply to budget comparison values and is only available when the Show Individual Account Lines option is checked. |

|

By Month, Quarter, Half Year and Year |

Each column will contain a single period of data. (Applies only to Actual-to-Budget for 3 and 4 periods and Actual History of 12 Periods reports (sub type 7, 9 and 8 respectively)). |

|

Use custom |

To turn on and off the use of the custom search design. |

|

Custom Search |

Click to design your own special search. |

|

Button |

Action |

|---|---|

|

Print Report |

Tab-delimited table for text type destinations. Will cause a report to be printed of the subject matter. You can change the Destination of the report by selecting the ‘Report Destination’ menu command. |

|

Cancel |

Aborts the process currently in session. The keyboard equivalent is the Esc key for Windows computers and Command-.(full stop or period) for the Mac. |

The window has 2 tab panes.

Profit and Loss

Provides profit and loss financial reports for the selected period(s).

There are a number of standard report types, which you can select from the list. Except for the Current Period Trial, you must select a period or range of periods.

The Current Period Trial takes data from the account’s current turnover and adjusts for transactions that may have fallen into later periods. This report gives an Income Statement for the position were a month-end to be processed. All other report types are specific to a period, or range of periods, and gain data from month-end historic results.

The Show Individual Account Lines option provides a full listing for all accounts. The normal prints the report in a consolidated manner, where accounts are consolidated into their respective report lines.

![]() CUSTOM CAPABILITY: You can use oCustom1 methods to provide for special custom reporting setup options. The method is as follows:

CUSTOM CAPABILITY: You can use oCustom1 methods to provide for special custom reporting setup options. The method is as follows:

$PrePLReportSetup()

Balance Sheet

Provides balance sheet financial reports for the selected period(s).

There are a number of standard report types, which you can select from the list. Except for the Current Period Trial, you must select a period or range of periods.

The Current Period Trial report takes data from the account’s current balances and adjusts for transactions that may have fallen into later periods. This report gives a Balance Sheet for the position were a month-end to be processed. All other report types are specific to a period, or range of periods, and gain data from month-end historic results.

The Show Individual Account Lines option provides a full listing for all accounts. The normal prints the report in a consolidated manner, where accounts are consolidated into their respective report lines.

![]() CUSTOM CAPABILITY: You can use oCustom1 methods to provide for special custom reporting setup options. The method is as follows:

CUSTOM CAPABILITY: You can use oCustom1 methods to provide for special custom reporting setup options. The method is as follows:

$PreBalSheetReportSetup()

Compiled in Program Version 5.10. Help data last modified 4 Jun 2012 04:47:00.00. Class wAcGlResultPrint last modified 17 Oct 2017 04:29:54.