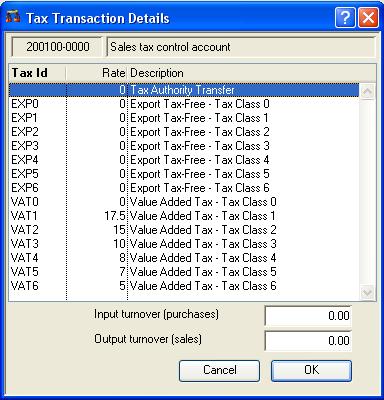

Tax Transaction Details

There are several reasons why you may wish to make a direct transaction to a Tax Accrual type Account (Simple or Journal):

1. Direct payment of taxed costs (for example, from the bank) without passing through an Accounts Payable account or the Petty Cash feature. In this case, you should select the tax identifier (tax code and class) applicable and enter the appropriate amount, without tax, for the costs in the Input Turnover box (negative for a credit).

2. Direct income of taxed sales without being invoiced in the normal way. In this case, you should select the tax identifier (tax code and class) applicable and enter the appropriate amount, without tax, for the sale in the Output Turnover box (negative for a credit).

3. Payment or refund of tax from a tax authority. In this case you should select the Tax Authority Transfer list option. If you do this, there is no turnover value to be entered and the transaction will be ignored in the Sales Tax analysis.

Choose the list option you wish, enter an Input or Output turnover and confirm with an OK. See the Tax Maintenance window for details of the tax system.

|

Field |

Description |

|---|---|

|

Tax account code |

General Ledger Accounts. Account code. {GLAFILE.GLACODE char 10} |

|

Description |

General Ledger Accounts. Description. {GLAFILE.GLADESC char 40} |

|

Tax option list |

List of all tax and class combinations. These are not tax regimes (which may contain more than one tax authority tax. Plus a special list entry for a transfer to or from a tax authority which will be ignored in the sales tax analysis. |

|

Input Turnover |

Ledger Transactions. Input goods (purchases) taxable turnover. {TRAFILE.TRATAXO number 2dp} |

|

Output Turnover |

Ledger Transactions. Output goods (sales) taxable turnover. {TRAFILE.TRATAXI number 2dp} |

|

Button |

Action |

|---|---|

|

Cancel |

Aborts the process currently in session. The keyboard equivalent is the Esc key for Windows computers and Command-.(full stop or period) for the Mac. |

|

OK |

The OK button updates the data you have entered, or confirms the selection and/or processes the function you have called. |

| See also: – |

Compiled in Program Version 5.10. Help data last modified 1 Aug 2002 16:55:00.00. Class wAcTaxAdj last modified 23 Sep 2017 10:50:46.