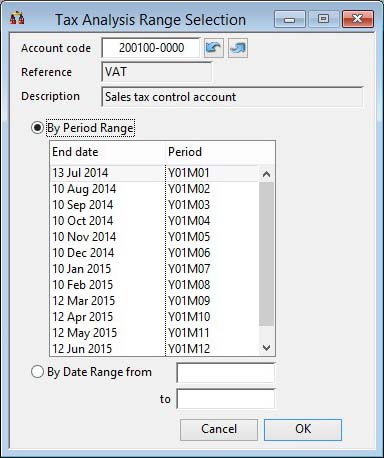

Tax Analysis Range Selection

This window enables you to select the tax accrual account and a time period for the tax analysis. You must select either a period range or enter a date range for collection of the data. Process the analysis with an OK or press the Enter key.

|

Field |

Description |

|---|---|

|

Tax accrual account |

You can use the G/L Account Scratchpad, keyword search, arrows or manual entry to select the Tax Accrual account you want to analyse. The G/L account must be of type T. |

|

By Period Range |

Use this choice to base the analysis on a range of your accounting periods. |

|

Period list |

Select the period for the report or the final period of the report. |

|

By Date Range from |

Use this choice to base the analysis on the dates entered for transactions. |

|

From date |

Enter data that restricts the records selected. If left blank, data will be selected from the maximum and minimum extremes in the file. All selections criteria you enter will have to be met by each record processed. |

|

To date |

Enter data that restricts the records selected. If left blank, data will be selected from the maximum and minimum extremes in the file. All selections criteria you enter will have to be met by each record processed. |

|

QP Discount Adjustment Report |

If checked, the analysis diverts from the normal tax analysis to the collection of Invoice value and tax data for invoices that have been awarded Quick Payment Discounts. The report calculates the tax adjustment that results from awarding discounts when the tax does not initially accommodate the QPD. The results can be used to post a tax adjustment journal. |

|

Button |

Action |

|---|---|

|

Cancel |

Aborts the process currently in session. The keyboard equivalent is the Esc key for Windows computers and Command-.(full stop or period) for the Mac. |

|

OK |

The OK button updates the data you have entered, or confirms the selection and/or processes the function you have called. |

| See also: – |

Compiled in Program Version 5.10. Help data last modified 23 Feb 2016 11:14:00.00. Class wAcTaxsel last modified 10 Oct 2017 11:47:55.