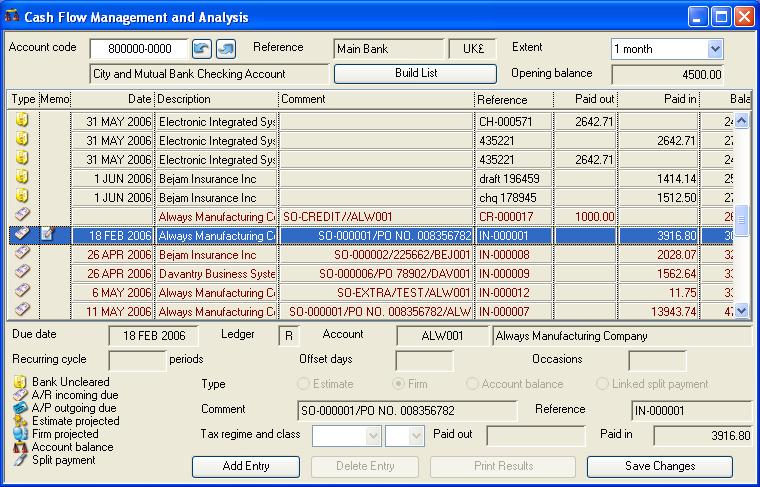

Cash Flow Management and Analysis

The Cash Flow system enables you to view predicted movements of bank account cash. Having selected a bank account, the Build List button function will:

- Collect all un-cleared bank account transactions.

- If it is the default bank account* collect all A/R transactions with due amounts.

- If it is the default bank account* collect all A/P transactions with due amounts.

- Collect any previously entered cash projections.

- It normalises all transactions into the bank account’s currency

- Sort the list and calculate the opening and running cash balance.

* The default bank account is that which is set in the Ledgers — Ledger Manager — Control Settings, Default Accounts tab pane.

If you are going to use this feature you should also be doing regular bank reconciliation using the Clear system in the Bank Account Review and Reconciliation window, otherwise the cash flow list will be unreasonably dominated by historic bank transactions.

To use this analysis tool you must first select a bank account and choose an extent which will control how far ahead the analysis will extend. Then click the Build List button.

To add a projected value, right click on the list and operate Add Entry or use the Add Entry button. You can assign an account from either of the ledgers and give any date when the cash movement is due to take place. However, the list is ordered by date AFTER the current uncleared bank account transactions recorded. Any overdue movements are indicated by red text.

Projected entries can be set to be recurring. Such entries are repeated on a the basis of the recurring cycle periods; 1 for monthly, 3 for quarterly, etc. The date after the anniversary of the period start of the entered date can be set by using the offset days field. Finally, you need to set the number of recurring occasions. For example, if you have a quarterly payment due on the 28th of the month following the quarter end and recurring over 4 years (16 periods), you would enter 3 periods, 28 days offset and 16 occasions. The system automatically ignores occurrences due prior to today and will automatically decrement down the occurrences as they drop off the calendar.

The type of entry is significant. Estimate and Firm and simple entries that are differentiated by displaying estimates in italics.

Account balance is a special type where the system populates the amount from the balance of the ledger account entered for the ledger period appropriate to the date. If the ledger chosen is either A/P or A/R, then any outstanding due amounts normally collected for these accounts are removed from the list. This is useful when a customer generally pays a months invoices at a time rather than individually. It is also useful for recording when sales tax returns are due to the revenue authority.

Split payment is also a special type which is used when an agreement has been made to split an invoice over a number of payments. This adjusts previous entries for the account with the same document reference, so you must have the correct ledger, account and document reference entered.

|

Field |

Description |

|---|---|

|

Bank account code |

General Ledger Accounts.Account code (combined account group and cost centre). {GLAFILE.GLACODE char 10 Idx} You can only enter a bank account here. |

|

Bank account reference |

General Ledger Accounts. User reference. {GLAFILE.GLAUSER char 255 Idx} |

|

Bank account currency |

General Ledger Accounts. Currency of the account. {GLAFILE.GLACUR char 3} All values in the analysis will be in this currency. |

|

Bank account description |

General Ledger Accounts. Description. {GLAFILE.GLADESC char 40} |

|

Extent |

Select the extent into the future that you want a cash flow analysis. |

|

Opening balance |

Shows the opening balance before any uncleared transactions listed below. Negative is overdrawn. |

|

Button |

Action |

|---|---|

|

Build List |

Click to build the transaction list and cash flow analysis. |

|

Field |

Description |

|---|---|

|

List |

A list of system generated and entered cash flow transactions on the bank account. The following columns are shown: |

|

Type icon |

Shows the type of entry. See the legend at the bottom left corner of the window. |

|

Memo icon |

Indicates whether there is a Memo record associated with the transaction. To view a memo, select the transaction in the list and double-click on the memo icon |

|

Date |

Transaction date. |

|

Description |

Customer or supplier name or account description. |

|

Comment |

Cash flow description or transaction comment. |

|

Reference |

Document reference. |

|

Paid out |

Payment out of the bank account (actually a credit transaction in the bank account). |

|

Paid in |

Payment into the bank account (actually a debit transaction in the bank account). |

|

Balance |

Running balance in bank account currency. |

|

|

When you click on a list line the following fields are shown below the list for the selected line. Where the entry is a projected cash flow entry, or the first in a repeating group, you will be permitted to edit the details. |

|

Date |

Cash Flow entries. Due date or base date for type 2 and recurring. {CASFILE.CASDUED date date1980} |

|

Ledger |

Ledger part of account identifier, either R for Receivable, P for Payable or G for General Ledger. |

|

Account code |

Account code of the Customer, Supplier or G/L account. |

|

Account name |

Customer or supplier name or account description. |

|

Recurring cycle |

Cash Flow entries. Recurring period type (0 = Period-end, N = N-Monthly on due date anniversary). {CASFILE.CASRECC integer shortint} |

|

Recurring offset days |

Cash Flow entries. Payment offset days for type 2. {CASFILE.CASOFFD integer} |

|

Recurring occasions |

Cash Flow entries. Recurring occasions. {CASFILE.CASRECU integer} |

|

Estimate |

Select this option if the entry is an estimate of a future transaction. |

|

Firm |

Select this option if the entry is a firm future transaction. |

|

Account balance |

Select this option for the balance on a A/P, A/R or G/L asset account. |

|

Linked split payment |

Select this option for a split payment linked by the account and document reference. |

|

Comment |

Cash Flow entries. Comment. {CASFILE.CASCOMM char 30} |

|

Tax regime and class |

If the payment is taxed, select a regime and class. Use the delete key to clear the lists to non-taxed. |

|

Reference |

Cash Flow entries. Document reference. {CASFILE.CASDOCR char 15 Idx} |

|

Paid out amount |

Payment out of the bank account (actually a credit transaction). |

|

Paid in amount |

Payment into the bank account (actually a debit transaction). |

|

Button |

Action |

|---|---|

|

Add Entry |

Click to add a projected cash movement entry, copying the currently selected line. This is the same as right-clicking on the list and operating Add Entry from the context menu. |

|

Delete Entry |

Click to delete the currently selected projected cash movement entry. This is the same as right-clicking on the list and operating Delete Entry from the context menu. |

|

Print Results |

To print the cash flow analysis. |

|

Save Changes |

Click to save any changes for use in a future Cash Flow review. |

Compiled in Program Version 5.10. Help data last modified 4 Jun 2012 04:47:00.00. Class wAcCashFlow last modified 26 Aug 2015 11:27:33.