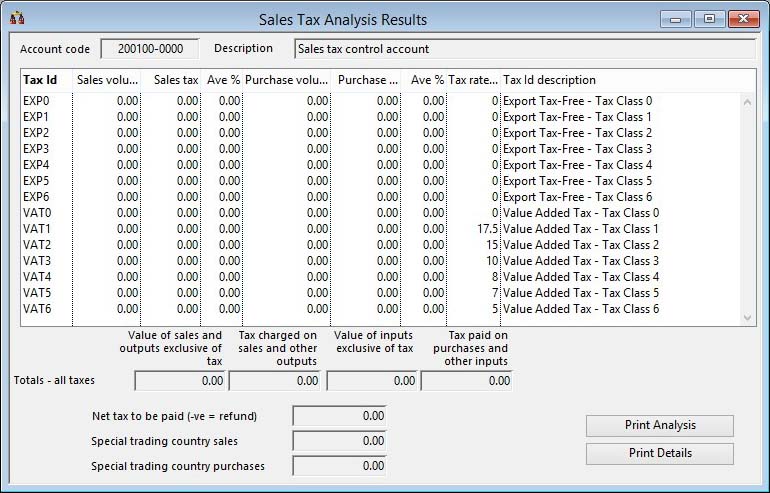

Sales Tax Analysis Results

The tax accrual account and period of analysis is set in the Tax Analysis Range Selection window that is presented. After analysis, which may take some time, a detailed summary is provided which can be used to prepare tax returns.

See the Tax Maintenance window for full details of the tax handling system.

The totals are shown separately for all tax and class combinations that have the selected G/L account as their accrual account.

![]() NOTE: Any Journal or Transaction Entries that have been marked as “Tax Authority Transfer” class transactions will be ignored in this analysis (I.E. have a blank Tax Id).

NOTE: Any Journal or Transaction Entries that have been marked as “Tax Authority Transfer” class transactions will be ignored in this analysis (I.E. have a blank Tax Id).

Sales Tax (VAT) analysis is based solely on the G/L tax accrual account transactions. The Input and Output turnover is stored in appropriate fields in the tax transaction records. As a result of this, zero tax rated sales or purchases will have zero tax value tax control transactions. This can be controlled with the checkbox in the Ledger Manager Control Settings.

Sales Tax analysis shows sales and purchase totals for those customers and suppliers that have been given countries that have been flagged as Special trading countries, in the “System Manager” “Countries” section.

You can print the analysis using the button provided. The rates shown on the right are the rates currently applying to the tax classes.

|

Field |

Description |

|---|---|

|

Tax Id |

The tax and class identifier (if the tax code is less than 3 characters spaces will be added). |

|

Sales volume |

This column of values shows the sales and other outputs exclusive of tax. |

|

Sales tax |

This column of values shows the tax charged on sales and other outputs. |

|

Average % |

Shows the calculated average rate for review purposes only. |

|

Purchases volume |

This column of values shows the inputs into the business (purchases) exclusive of tax. |

|

Purchase tax |

This column of values shows the tax paid on purchases and other inputs. |

|

Average % |

Shows the calculated average rate for review purposes only. |

|

Tax rate % |

This rate shows the current rates for the tax class combination. |

|

Net tax to be paid |

This is the combined value of total tax received and paid out. This value is the sum due to the tax authorities (-ve for a refund). |

|

Special trading country sales |

This is the total of sales, exclusive of tax, made to customers whose country has been marked as having special trading status. |

|

Special trading country purchases |

This is the total of purchases, exclusive of tax, made from suppliers whose country has been marked as having special trading status. |

|

Button |

Action |

|---|---|

|

Print Analysis |

Provides a report of the analysis shown on this window. |

|

Print Details |

To print a detailed report of all transactions in the tax control account for the selected period. You will be offered at this point an option to include contra account and name for reconciliation purposes. |

| See also: – |

Compiled in Program Version 5.10. Help data last modified 17 May 2012 10:02:00.00. Class wAcTaxanal last modified 24 Apr 2018 09:02:39.