Asset Register Maintenance

An Asset Register can be maintained and depreciation automatically applied to G/L accounts. Each asset is assigned a code and can have a user reference and description. Each asset is assigned to an “Asset account” and a “Depreciation account”

![]() NOTE: NOTE: If the Ledgers are Un-Locked (see the Non-Balancing Transactions sub-topic under Ledgers Manager), you will be asked on entering the Asset Register whether you wish to add Assets without recording Purchase transfer transactions.

NOTE: NOTE: If the Ledgers are Un-Locked (see the Non-Balancing Transactions sub-topic under Ledgers Manager), you will be asked on entering the Asset Register whether you wish to add Assets without recording Purchase transfer transactions.

If you answer No, or if the Ledgers are Locked, when you add an Asset you must transfer it from an account into which you have charged the cost of its acquisition. The purchase value will then be the current value. However, if you answer Yes to the above question, you can then enter as many Assets as you like AND set the current value to an amount less than the purchase value. This feature is provided for setting up the Asset Register in the first place and will lead inevitably to account imbalances that can be put right by one or more Non-balancing Transactions.

Maintenance

Within the maintenance window all asset activities can be undertaken. Depreciation can take four forms and can be applied individually or globally during an accounting period. An asset register report can be printed.

To change details or dispose of the asset, you must confirm with the Save button. You are free to change the current value; this, in effect, is a revaluation and will be processed as such.

|

Transaction process |

Asset Re-valuation |

Type 007 |

|---|---|---|

|

Credit |

Increased value |

to G/L depreciation a/c |

|

Debit |

Increased value |

to G/L asset a/c |

You are permitted to change asset and depreciation accounts, however, they will only be used for depreciation transactions afterwards and not retrospectively. If you change the asset account you must manually transfer the asset current value in a G/L Simple Transaction.

If you change scrap value, depreciation type or rates, these will be applicable immediately and the next depreciation posting will be reflect any change.

Adding a New Asset

To record an asset on the register use the New button. This process automatically debits the asset purchase to a G/L asset account and credits a G/L purchase type account. Consequently, you should have first recorded the purchase of the asset in the A/P ledger.

You must enter a unique code for the asset. The Asset account must be a G/L account assigned to the balance sheet report.

An additional Purchase Account field will be made available for you to enter the G/L account to which the asset was originally posted.

|

Transaction process |

Asset Acquisition |

Type 006 |

|---|---|---|

|

Credit |

Purchase value |

to G/L purchase a/c |

|

Debit |

Purchase value |

to G/L asset a/c |

The Accumulated Depreciation Account is optional. If left blank, the balance from a depreciation posting is posted to the Asset account which thus shows current net value for the asset.

|

Transaction process |

Asset Depreciation |

Type 008 |

|---|---|---|

|

Credit |

Depreciation amount |

to G/L asset a/c |

|

Debit |

Depreciation amount |

to G/L depreciation a/c |

If you enter an account, it must be assigned to the balance sheet report. In that case when depreciation is posted to the Depreciation account the balancing value will be posted to the accumulated depreciation account. The Asset account will always retain the original value.

|

Transaction process |

Asset Depreciation (alternative) |

Type 008 |

|---|---|---|

|

Credit |

Depreciation amount |

to G/L accumulated depreciation a/c |

|

Debit |

Depreciation amount |

to G/L depreciation a/c |

The Depreciation account is that trading (purchase type) G/L account to which depreciation will be charged, when posted to a regular purchase type account.

The Purchase value should be the initial asset value, and can not be edited later.

The Scrap value is the residual value, if any, that the asset is expected to have at the end of its depreciated life.

Four depreciation types are available:

1. Not charged automatically means that a standard depreciation is never automatically applied. With this method, depreciation can be individually posted for a period.

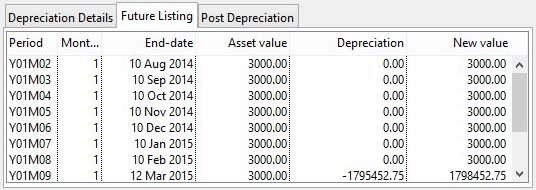

2. The Straight line method is a simple depreciation method. Any scrap value is subtracted from the purchase price, and the result charged in equal instalments over the estimated life of the asset. You can apply a percent rate per month, an amount per month or a number of months of life. The applicable depreciation for this and the next period is shown, and you can view a list of future depreciation for the periods of the accounting calendar by clicking on the Future Listing pane.

3. The Reducing balance method is a complex arithmetic system of calculating depreciation. A finite scrap value is mandatory. Using this method, the depreciation rate/month is applied to the current value (rather than purchase cost less scrap value). This means that for a given life, greater depreciation is applied at the start of its life than at the end. You may apply a rate, current period amount or number of months of life. Use the Future Listing pane to view the projected results for the account calendar periods.

4. The Sum of digits method is a similar method to the reducing balance. The digits of the number of months are added up for the useful life, and the depreciation is charged in a descending order. For example, if five months is the life: 15 = (5 + 4 + 3 + 2 +1), 1st months depreciation = 5/15 of the purchase price – scrap value, 2nd month is 4/15, then 3/15, 2/15 and 1/15. You can only enter a number of months of useful life. Use the Future Listing pane to view the projected results for the account calendar periods.

Deleting or Disposal

You can delete an asset from the register only when it has no current value. It must have been disposed of.

Disposal is processed as a consequence of an Edit in which you enter a Disposal price. Any profit or loss on disposal will be posted to the Depreciation account. The disposal date will be automatically assigned with the current ledger transaction date. You must enter a Sales account into which the asset sale is to be posted. You can then sell the asset using standard invoicing.

|

Transaction process |

Asset Disposal |

Type 009 |

|---|---|---|

|

Credit |

Current value |

to G/L asset a/c |

|

Debit |

Disposal loss |

to G/L depreciation a/c |

|

Debit |

Disposal price |

to G/L sales, bank or cash a/c |

|

Field |

Description |

|---|---|

|

Asset code |

Asset Register. Asset code (Unique). {ASSFILE.ASSCODE char 6} |

|

User reference |

Asset Register. Asset user index. {ASSFILE.ASSUSER char 15} |

|

Asset description |

Asset Register. Asset description. {ASSFILE.ASSDESC char 40} |

|

Asset account |

Asset Register. Asset G/L Account. {ASSFILE.ASSACCO char 10} |

|

Accumulated depreciation account |

Asset Register. Accumulated depreciation G/L account (optional). {ASSFILE.ASSACDE char 10} |

|

Depreciation account |

Asset Register. Depreciation G/L account. {ASSFILE.ASSDEAC char 10} |

|

Purchase date |

Asset Register. Purchase date. {ASSFILE.ASSPURD date date1980} |

|

Purchase value |

Asset Register. Purchase value. {ASSFILE.ASSPURV number 2dp} |

|

Current value |

Asset Register. Current value. {ASSFILE.ASSCURV number 2dp} |

|

Scrap value |

Asset Register. Scrap value. {ASSFILE.ASSCRAP number 2dp} |

|

Depreciation due |

Total depreciation remaining to be posted. |

|

Disposal date |

Asset Register. Disposal price. {ASSFILE.ASSDISP number 2dp} |

|

Disposal date |

Asset Register. Date of disposal. {ASSFILE.ASSDISD date date1980} |

|

Details and notes |

Asset Register. Additional text. {ASSFILE.ASSTEXT char 32000} |

|

Scale Picture To Fit |

Check this option to view the full picture scaled to fit. |

|

Picture |

Asset Register. Picture of the asset. {ASSFILE.ASSPICT picture} |

|

Button |

Action |

|---|---|

|

Show List |

Click to build a list of all assets from which you can select one to maintain. |

|

Find |

Enables you to enter a value in an indexed field. With the cursor in the field of interest, execute an OK. The record with the closest match to the entered value will be found and displayed. |

|

New |

This will create a new (normally blank) record in the file. You will then be able to enter details for the record. Then confirm with an OK, or abandon the New record with a Cancel. |

|

Delete |

Execute this button to permanently remove the currently selected record from the file. If you are permitted to delete the item, you will be asked for confirmation, otherwise an explanation will be given. |

|

|

You will be presented with the Print Asset Report Selection window. |

|

Revert |

To revert any changes to the previously saved version. |

|

Save |

To save the changes you have made to the data file. |

The window has 3 tab panes.

Depreciation Details

Future Listing

Post Depreciation

Depreciation Details

The method and values for period depreciation.

|

Field |

Description |

|---|---|

|

|

Depreciation type |

|

Not Charged Automatically |

Asset Register. Depreciation type 0,1,2,3. {ASSFILE.ASSTYPE integer shortint} |

|

Straight Line Method |

Asset Register. Depreciation type 0,1,2,3. {ASSFILE.ASSTYPE integer shortint} |

|

Reducing Balance Method |

Asset Register. Depreciation type 0,1,2,3. {ASSFILE.ASSTYPE integer shortint} |

|

Sum of Digits Method |

Asset Register. Depreciation type 0,1,2,3. {ASSFILE.ASSTYPE integer shortint} |

|

Currency |

The currency of the asset account in which all values will apply. |

|

Rate |

Asset Register. Depreciation % rate/month. {ASSFILE.ASSRATE number 4dp} |

|

Amount |

Asset Register. Depreciation amount/month. {ASSFILE.ASSDEPR number 2dp} |

|

Periods |

The number of periods depreciation will be applied. |

|

Last period depreciation applied |

Asset Register. Last period number of depreciation. {ASSFILE.ASSLAST number 0dpShortnum} |

|

Depreciation due this period |

The value of depreciation due in the current period. |

|

Depreciation due next period |

The value of depreciation due in the next period. |

Future Listing

Listing of future period depreciation, to the extent of the ledger calendar.

Provides a listing of the depreciation profile for the asset over the ledger calendar.

Post Depreciation

Functions to post depreciation for the selected or all assets.

There are two methods of posting depreciation for an accounts calendar period. You can individually post depreciation for a specific asset by first selecting it in the window, then click on the Post This Asset’s Period Depreciation button. Alternatively, you can globally post all depreciation from all assets for the current period using the Post All Depreciation for This Period button. This operation should always be carried out prior to Month-end processing. Depreciation is only ever posted once for a period.

|

Transaction process |

Asset Depreciation |

Type 008 |

|---|---|---|

|

Credit |

Depreciation amount |

to G/L asset a/c |

|

Debit |

Depreciation amount |

to G/L depreciation a/c |

|

Button |

Action |

|---|---|

|

Post This Asset’s Period Depreciation |

To post the depreciation on the currently selected asset for the current period. |

|

Post All Depreciation for This Period |

To post the depreciation on all assets for the current period. |

| See also: – |

Compiled in Program Version 5.10. Help data last modified 4 Jun 2012 04:47:00.00. Class wAcGlAssets last modified 10 Oct 2017 11:47:49.