Job Invoicing and Crediting

This window is used for both the Process — Job Processing — Invoice a Job function and the Process — Job Processing — Credit on a Job function, with appropriate modifications to its appearance.

There are two methods of invoicing jobs:

|

Type |

Description |

|---|---|

|

Line Items Method |

This method effectively allows you to invoice on a line by line basis in much the same way as a Sales Order transfers its line items to an Invoice on dispatch. This is useful where you want to itemise the invoice in detail and populate the sales history with parts. This method can be used if the General Invoicing (not line items) checkbox IS NOT checked in the Job Maintenance window. |

|

General Method |

This method ignores line items and allows you to invoice with general invoice lines in much the same way as an Invoice created in the Ledgers — Accounts Receivable — New Invoice (Not Dispatch) function. This method can be used if the General Invoicing (not line items) checkbox IS checked in the Job Maintenance window. When the Job is set for General Invoicing there is no Line Invoicing tab pane available to you in this window. |

To create an Invoice for a Job, use the Line Invoicing tab pane, if available, in which you can apply lines to the invoice that you will process in the General Invoicing tab pane. You can always add extra non-specific line items in the General Invoicing tab pane.

|

Field |

Description |

|---|---|

|

Job number |

Jobs. Job code number = jst(MCDJOBS,’-6N0P0′). {JOBFILE.JOBCODE char 6} |

|

Customer code |

Customers. Unique customer identification code. {CUSFILE.CUSCODE char 6} |

|

Customer name |

Customers. Customer company name. {CUSFILE.CUSCNAM char 40} |

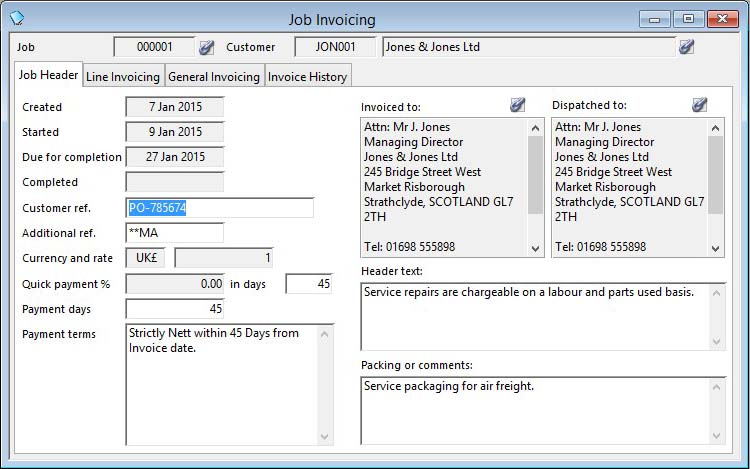

The window has 4 tab panes.

Job Header

Line Invoicing

General Invoicing

Invoice History

Job Header

Job details that will be used for the Invoice or Credit Note.

|

Field |

Description |

|---|---|

|

Created date |

Jobs. Date job created. {JOBFILE.JOBDATE date date1980} |

|

Started date |

Jobs. Date job started. {JOBFILE.JOBDATS date date1980} |

|

Due for Completion date |

Jobs. Date job due for completion. {JOBFILE.JOBDUED date date1980} |

|

Completed date |

Jobs. Date job completed. {JOBFILE.JOBDATC date date1980} |

|

Customer reference |

Jobs. Customer reference. {JOBFILE.JOBCREF char 20} |

|

Additional reference |

Jobs. Additional user reference. {JOBFILE.JOBAREF char 6} |

|

Currency |

Jobs. Currency code. {JOBFILE.JOBCUR char 3} |

|

Exchange rate |

Jobs. Currency exchange rate. {JOBFILE.JOBRATE number float} |

|

Quick payment discount |

Jobs. Quick payment discount %. {JOBFILE.JOBQPDI number 2dpShortnum} |

|

Quick payment days |

Jobs. Quick-payment days (or months) which will be used to generate invoice quick-payment date. {JOBFILE.JOBQPDA number 0dpShortnum} |

|

Payment days |

Jobs. Payment days. {JOBFILE.JOBPDAY number 0dpShortnum} |

|

Payment terms |

Jobs. Payment terms to customer. {JOBFILE.JOBTERM char 1000} |

|

Invoice address |

Contact and address that the invoice is addressed to (either default, additional or individual). |

|

Dispatch address |

Contact and address that it was dispatched to (either default, additional or individual). |

|

Header text |

Jobs. Header text. {JOBFILE.JOBHEAD char 10000000} |

|

Packing or comments |

Jobs. Comments. {JOBFILE.JOBCOMM char 10000000} |

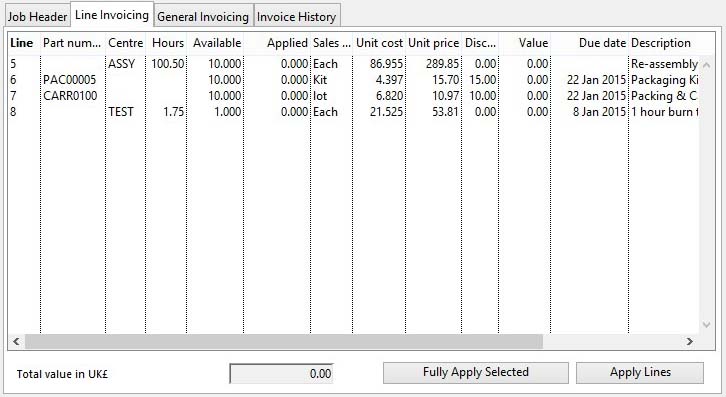

Line Invoicing

Details of line item invoicing or crediting. This pane is not available if the General Invoicing (not line items) checkbox IS checked in the Job Maintenance window.

|

Field |

Description |

|---|---|

|

Available Line Item List |

List of available job lines. You can individually edit the applied quantity. Double-click to put a part into the ScratchPad.

|

|

Total value |

The total value of balance quantity items (without tax) for the order in the currency shown. |

|

Button |

Action |

|---|---|

|

Fully Apply Selected |

To fully apply available quantity to selected lines. |

|

Apply Lines |

To transfer the applied lines to the invoicing pane. |

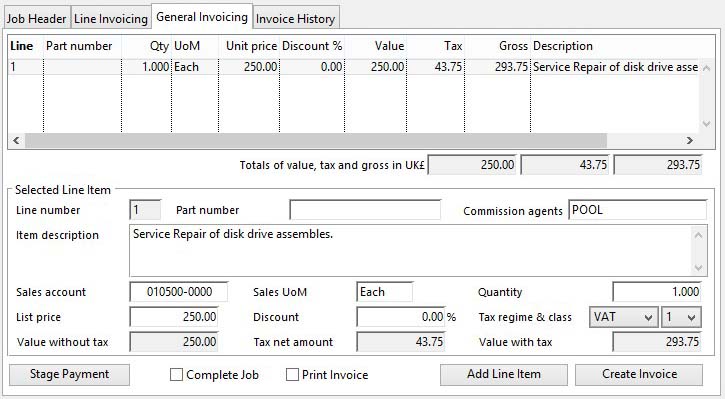

General Invoicing

Details of the general invoicing or credit to be made.

|

Field |

Description |

|---|---|

|

Invoice Item List |

List of line items for the invoice or credit note. |

|

Total value without tax |

The total value (without tax) for the listed items. |

|

Total Tax |

The total tax for the listed items. |

|

Total with Tax |

The total gross for the listed items. |

|

Line number |

Sales History. Invoice Line Number (may be different from SO line number). {SAHFILE.SAHINVL number 0dpShortnum} |

|

Part number |

Sales History. Part number. {SAHFILE.SAHPTNO char 18} |

|

Commission agents |

Sales History. Commission agents posted commission for this line item (comma separated list of COMIDs). {SAHFILE.SAHCOMA char 100}

|

|

Item description |

Sales History. Item description if not a Part numbered item. {SAHFILE.SAHDESC char 32000} |

|

Sales account |

Sales History. G/L sales posting account code. {SAHFILE.SAHACCO char 10} |

|

Sales UoM |

Sales History. Sales Unit of measure. {SAHFILE.SAHSAUM char 6} |

|

Quantity |

Sales History. Quantity delivered per sales unit of measure. {SAHFILE.SAHQTY number 3dp} |

|

List price |

Sales History. Price per sales unit of measure before discount. {SAHFILE.SAHPSUM number 2dp} |

|

Discount rate |

Sales History. Discount percent given to customer. {SAHFILE.SAHDISC number 2dpShortnum} |

|

Tax regime and class |

Sales History. Tax regime code applied. {SAHFILE.SAHTAMC char 6} and Sales History. Sales tax class. {SAHFILE.SAHTAXC char 1}. Sales tax regime appropriate for the customer and the class appropriate to the goods being sold. Select from the dropdown lists. (See the Tax Maintenance window for details of the tax system.) By default the customer’s tax regime is applied or that of the dispatch additional address (if one is applied). The tax class applied by default is that of the part or the default sales non-part class set in the company details. |

|

Tax Rate |

The current net tax rate for the entered tax regime and class. |

|

Value without tax |

The value of the selected item in the Invoice, exclusive of tax. |

|

Tax amount |

Sales History. Tax applied on dispatch quantity. {SAHFILE.SAHTAX number 2dp} |

|

Value with tax |

The value of the selected item in the Invoice, inclusive of tax. |

|

Complete Job |

Check to complete the Job or uncheck to re-open it. |

|

Print Invoice |

To print a Invoice or Credit Note after it has been saved. |

|

Button |

Action |

|---|---|

|

Stage Payment |

To add a stage payment for the job to the invoice. This will open the Job Stage Payments window in which you can enter a number of amounts proportional to the sales value of the job. |

|

Add Line Item |

To add a non-part (or non-stock part) line entry to the document. |

|

Create Invoice |

After preparing the document lines above, click to save and process the document. |

![]() The window permits the production of a zero value general invoice. This may be useful when wishing to document some stage in a job or when the job is undertaken free of cost to the customer. To do this you must have at least one line item.

The window permits the production of a zero value general invoice. This may be useful when wishing to document some stage in a job or when the job is undertaken free of cost to the customer. To do this you must have at least one line item.

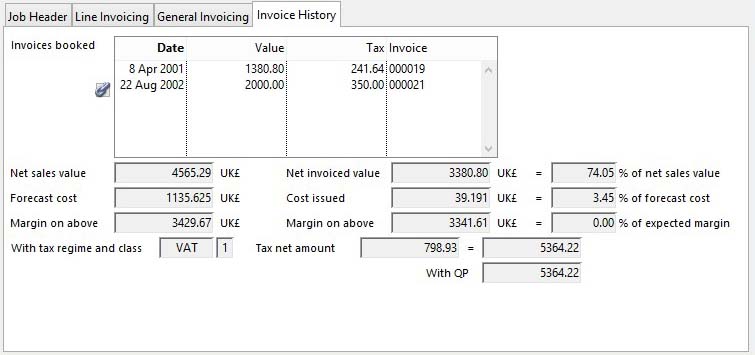

Invoice History

Select to review previous invoice history and other financial details of the job.

|

Field |

Description |

|---|---|

|

Invoices booked |

Jobs. List of invoices and credit notes applied to the job with value and tax. {JOBFILE.JOBINV list} |

|

Net sales value |

Jobs. Total net sales value after discounts (without tax) in currency. {JOBFILE.JOBSALE number 2dp} |

|

Net invoiced value |

Jobs. Total invoiced value (without tax) in currency. {JOBFILE.JOBINVV number 2dp} |

|

% Invoiced |

Percent of net sales value that has been invoiced. |

|

Forecast cost |

Jobs. Cost current forecast in currency. {JOBFILE.JOBFORE number 3dp} |

|

Cost issued |

Jobs. Cost value issued or recorded to date in currency. {JOBFILE.JOBCOST number 3dp} |

|

% Issued Cost |

Percent of forecast cost that has been issued. |

|

Margin on Forecast |

The net amount of net sales value above forecast cost. |

|

Margin on Issued |

The net amount of net invoiced value above cost issued. |

|

% Issued Margin |

Percent of forecast cost that has been issued. |

|

Tax regime and class |

Jobs. Tax regime applied to general invoicing, {JOBFILE.JOBTAMC char 6}, and Tax class applicable when general invoicing, {JOBFILE.JOBTAXC char 1}. |

|

Tax rate |

Jobs. Tax % applied to general invoicing. {JOBFILE.JOBTAX number 2dpShortnum} |

|

Tax amount |

The amount of tax payable on the net sale value at the rate. |

|

Sales Price with Tax |

The net sale price plus tax without any quick payment discount. |

|

Sales Price with Tax with Quick-pay Discount |

The net sale price plus tax and any quick payment discount. |

| See also: – |

Compiled in Program Version 5.10. Help data last modified 4 Jun 2012 04:48:00.00. Class wJobInvoice last modified 10 Oct 2017 11:48:17.