Invoice and Credit Note Change and Create

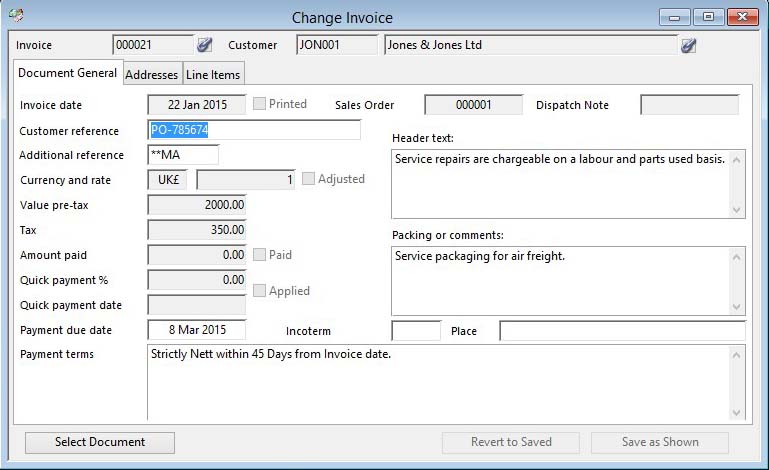

The window contains three tab panes. The same window is used to create a new non-dispatch invoice or credit note or to amend an existing document.

![]() WARNING: You can only amend documents that have been created in the current Accounts Receivable accounting period.

WARNING: You can only amend documents that have been created in the current Accounts Receivable accounting period.

The parameters available for a non-dispatch Invoice are normally provided on the Sales Order or Job when an invoice is created at the time of a SO dispatch or Job Invoicing. You can enter a customer reference, additional reference, a payment due date, amend the default payment terms for the customer, set a foreign currency and select an alternative invoice and/or delivery address. When you are happy with the parameters, use the Save button.

![]() WARNING: All items are created as sales history records and therefore it is assumed they are dispatched to the customer.

WARNING: All items are created as sales history records and therefore it is assumed they are dispatched to the customer.

|

Field |

Description |

|---|---|

|

Invoice number |

Invoices. Invoice number. {INVFILE.INVNO char 6} This is either an Invoice, Credit Note, CBD Invoice or blank when Not Invoiced. |

|

Customer code |

Customers. Unique customer identification code. {CUSFILE.CUSCODE char 6} |

|

Customer name |

Customers. Customer company name. {CUSFILE.CUSCNAM char 40} |

|

Button |

Action |

|---|---|

|

Select Document |

To select another document for changing. You will be asked to select an invoice in the Invoice or Credit Note Selection window. |

|

Revert to Saved |

To revert any changes to the previously saved version. |

|

Save as Shown |

To save the changes you have made to the data file. |

When an Invoice

|

Transaction process |

Sales Invoice |

Type 010 or 011 |

|---|---|---|

|

Debit |

Net-Disc+Tax amount |

to A/R customer a/c |

|

Credit |

Net amount only |

to G/L sales a/c |

|

Credit |

Tax amount only |

to G/L tax control a/c(s) |

|

Credit |

Discount amount only |

to G/L discount control a/c |

|

Debit |

Net-Disc+Tax amount |

to G/L debtors control a/c |

If your Ledgers Manager has checked the Do not use checkbox beside the Discount control account then the transaction postings for the Invoice will not separate out the discount amount.

|

Transaction process |

Sales Invoice (Alt.) |

Type 010 or 011 |

|---|---|---|

|

Debit |

Net-Disc+Tax amount |

to A/R customer a/c |

|

Credit |

Gross-Disc amount |

to G/L sales a/c |

|

Credit |

Tax amount only |

to G/L tax control a/c(s) |

|

Debit |

Net-Disc+Tax amount |

to G/L debtors control a/c |

When an Credit Note

|

Transaction process |

Sales Credits |

Type 012 or 013 |

|---|---|---|

|

Credit |

Net-Disc+Tax amount |

to A/R customer a/c |

|

Debit |

Net amount only |

to G/L sales a/c |

|

Debit |

Tax amount only |

to G/L tax control a/c(s) |

|

Debit |

Discount amount only |

to G/L discount control a/c |

|

Credit |

Net-Disc+Tax amount |

to G/L debtors control a/c |

If your Ledgers Manager has checked the Do not use checkbox beside the Discount control account then the transaction postings for the Invoice will not separate out the discount amount.

|

Transaction process |

Sales Credits (Alt.) |

Type 012 or 013 |

|---|---|---|

|

Credit |

Net-Disc+Tax amount |

to A/R customer a/c |

|

Debit |

Net-Disc amount |

to G/L sales a/c |

|

Debit |

Tax amount only |

to G/L tax control a/c(s) |

|

Credit |

Net-Disc+Tax amount |

to G/L debtors control a/c |

![]() CUSTOM CAPABILITY: Option optAcCreditsAutoClear, if Set to 1 or Yes, will prevent the Credit Note transactions in the Accounts Receivable ledger from being automatically cleared. If you set this option, all Credits to the A/R will have to be cleared manually. See Program Options Listing topic.

CUSTOM CAPABILITY: Option optAcCreditsAutoClear, if Set to 1 or Yes, will prevent the Credit Note transactions in the Accounts Receivable ledger from being automatically cleared. If you set this option, all Credits to the A/R will have to be cleared manually. See Program Options Listing topic.

The window has 3 tab panes.

Document General

Addresses

Line Items

Document General

General details of the document.

|

Field |

Description |

|---|---|

|

Invoice date |

Invoices. Date creation date. {INVFILE.INVDATE date date1980} |

|

Printed |

Invoices. Invoice printed (True when printed). {INVFILE.INVPRIN boolean} |

|

Sales Order |

Invoices. Source document depending on source type (SO number, code or Job number). {INVFILE.INVSONO char 6} |

|

Dispatch Note |

Invoices. Dispatch Note number. {INVFILE.INVDESP char 6} |

|

Customer reference |

Sales History. Customer order reference. {SAHFILE.SAHCREF char 20} |

|

Additional reference |

Sales History. Additional user reference. {SAHFILE.SAHAREF char 6} |

|

Header text |

Invoices. SO header text. {INVFILE.INVTRTX char 32000} |

|

Packing or comments |

Invoices. Dispatch or Packing instructions from SOHCOMM. {INVFILE.INVPACK char 32000} |

|

Currency |

Invoices. Currency symbol code. {INVFILE.INVCUR char 3}

|

|

Exchange rate |

Invoices. Currency rate applicable when issued. {INVFILE.INVRATE number float} |

|

Adjusted |

Invoices. Currency adjustment applied to ledgers flag. {INVFILE.INVCUAP boolean} |

|

Value pre-tax |

Invoices. Invoice pre-tax value. {INVFILE.INVVALU number 2dp} |

|

Tax |

Invoices. Invoice pre-tax value. {INVFILE.INVVALU number 2dp} |

|

Amount paid |

Invoices. Invoice amount paid. {INVFILE.INVPAY number 2dp} |

|

Paid |

Invoices. Invoice paid (True=paid). {INVFILE.INVPAID boolean} |

|

Quick payment % |

Invoices. Quick payment discount percent. {INVFILE.INVQPDI number 2dpShortnum} |

|

Quick payment date |

Invoices. Quick-payment date after which the discount is not available. {INVFILE.INVQPDT date date1980} |

|

Applied |

Invoices. Quick payment discount received on payment flag. {INVFILE.INVQPAP boolean} |

|

Payment due date |

Invoices. Payment due date. {INVFILE.INVDUED date date1980} |

|

Incoterm |

Invoices. Incoterm code (Blank or IDXTYPE=9). {INVFILE.INVINCO char 4} Incoterms are the internationally agreed method of designating trading transactions which cross national borders. They define the limits of commercial responsibility for the selling party and so clearly define the limits of cost of the delivery of the goods. In the system they are defined in File — System Manager — Index Codes. An Incoterm generally requires a parameter which is usually a place or port name. A Sales Order or Job Incoterm will be copied to any resulting invoices. |

|

Incoterm Place |

Invoices. Incoterm parameter (usually a named place or port). {INVFILE.INVINCP char 60} |

|

Payment terms |

Invoices. Payment terms. {INVFILE.INVTERM char 1000} |

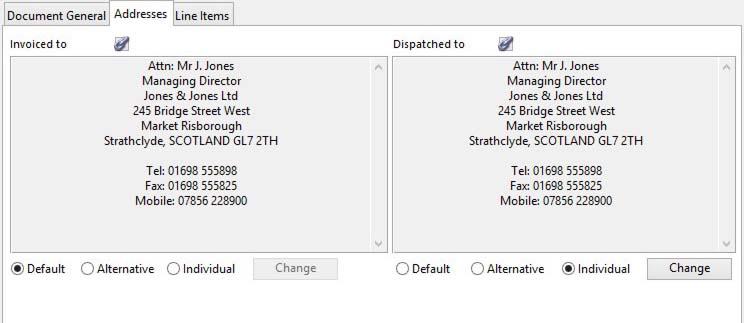

Addresses

Invoice and dispatch addresses.

An individual address is either or both an invoice or dispatch address that is specifically stored against the document and not stored either against the customer record or in the additional address file for the customer.

|

Field |

Description |

|---|---|

|

Invoice address |

Contact and address that the invoice is addressed to (either default, alternative or individual). Right-click on this field to obtain print functions for the currently selected address and contact (default for customer, if individual address):

Print Standard Letter opens the Standard Letter Selection window and Print 4×4 Label opens the 4 by 4 Label Position window. |

|

Default customer address |

This sets the address to the customers default address. |

|

Alternative address |

Clicking on this option when it is not already selected (or clicking Change if it is), opens the Address Selection window so that an address and/or contact can be selected. |

|

Individual address |

Clicking on this option when it is not already selected (or clicking Change if it is), will set the address field to edit mode so that a unique address can be entered. |

|

Change |

To create or select an alternative Invoice Address that would be applied to this document. |

|

Delivery address |

Contact and address that it was dispatched to (either default, alternative or individual). The print functions and likewise available from the context menu. |

|

Default customer address |

This sets the address to the customers default address. |

|

Alternative address |

Clicking on this option when it is not already selected (or clicking Change if it is), opens the Address Selection window so that an address and/or contact can be selected. |

|

Individual address |

Clicking on this option when it is not already selected (or clicking Change if it is), will set the address field to edit mode so that a unique address can be entered. |

|

Change |

To create or select an alternative Delivery Address that would be applied to this document. |

Line Items

Invoice line item details

|

Field |

Description |

|---|---|

|

Items list |

List of all line items (sales history) on file for the document shown above. |

|

Total value |

The total value (without tax) for the listed items. |

|

Total tax |

The total tax for the listed items. |

|

Total with tax |

The total gross for the listed items. |

|

Invoice line number |

Sales History. Invoice Line Number (may be different from SO line number). {SAHFILE.SAHINVL number 0dpShortnum} |

|

Part number |

Sales History. Part number. {SAHFILE.SAHPTNO char 18 Idx} |

|

Commission agents |

Sales History. Commission agents posted commission for this line item (comma separated list of COMIDs). {SAHFILE.SAHCOMA char 100}

|

|

Item description |

Sales History. Item description if not a Part numbered item. {SAHFILE.SAHDESC char 32000} |

|

Marketing project code |

Sales History. Marketing project code from SOLMKTP or JOBMKTP (IDXID = con(‘0’,SAHMKTP)). {SAHFILE.SAHMKTP char 4 Idx} See the Marketing Data Maintenance window help for more details of Marketing Project codes and their use. |

|

Marketing project description |

Index and Other Codes. Index code, scrap reason, QA test or Incoterm description. {IDXFILE.IDXDESC char 255} |

|

Show |

Lists the available marketing codes set up the File — System Manager — Index Codes. Double-click on a listed code to enter that value. |

|

Sales account |

Sales history. G/L sales posting account code. {SAHFILE.SAHACCO char 10 Idx} |

|

Sales UoM |

Sales History. Sales Unit of measure. {SAHFILE.SAHSAUM char 6} |

|

Quantity |

Sales History. Quantity delivered per sales unit of measure. {SAHFILE.SAHQTY number 3dp} |

|

List price |

Sales History. Price per sales unit of measure before discount. {SAHFILE.SAHPSUM number 2dp} |

|

Discount |

Sales History. Discount percent given to customer. {SAHFILE.SAHDISC number 2dpShortnum} |

|

Tax regime and class |

Sales History. Tax regime code applied. {SAHFILE.SAHTAMC char 6} and Sales History. Sales tax class. {SAHFILE.SAHTAXC char 1}. Sales tax regime appropriate for the customer and the class appropriate to the goods being sold. Select from the dropdown lists. (See the Tax Maintenance window for details of the tax system.) By default the customer’s tax regime is applied or that of the dispatch additional address (if one is applied). The tax class applied by default is that of the part or the default sales non-part class set in the company details. |

|

Tax rate |

The current tax net rate for the entered tax regime and class. |

|

Value without tax |

The value of the selected item in the Invoice, exclusive of tax. |

|

Tax amount |

Sales History. Tax applied on dispatch quantity. {SAHFILE.SAHTAX number 2dp} |

|

Value with tax |

The value of the selected item in the Invoice, inclusive of tax. |

|

Button |

Action |

|---|---|

|

Add Item |

To add a non-part (or non-stock part) line entry to the document. |

You can add items using the this button. Enter data as if you were creating a non-part sales order item. The sales account code defaults to the default non-part sales account but can be changed to any sales type G/L account. If you hold the shift key down when passing out of the account code box, the system will accept a non-Sales type G/L account, otherwise only a ‘S’ type account will be permitted.

![]() TIP: You can create Tax-Only Invoice or Credit Note line items using the following technique: Type in the leading significant characters of the Default Sales Tax Account (as entered in Ledgers — Ledgers Manager — Control Settings and the Defaults tab pane), hold the shift key down and press the Tab key. Leave nothing in the List price and Discount boxes, enter a non-zero value in the Tax class box. After tabbing, the cursor will then move to the Tax value position, where you may enter a tax amount. This procedure is only provided for exceptional tax transactions normally confined to export trading special circumstances.

TIP: You can create Tax-Only Invoice or Credit Note line items using the following technique: Type in the leading significant characters of the Default Sales Tax Account (as entered in Ledgers — Ledgers Manager — Control Settings and the Defaults tab pane), hold the shift key down and press the Tab key. Leave nothing in the List price and Discount boxes, enter a non-zero value in the Tax class box. After tabbing, the cursor will then move to the Tax value position, where you may enter a tax amount. This procedure is only provided for exceptional tax transactions normally confined to export trading special circumstances.

| See also: – |

Compiled in Program Version 5.10. Help data last modified 4 Jun 2012 04:47:00.00. Class wAcArInvChange last modified 23 Sep 2017 10:50:44.