Caliach ERP Tutorial

This tutorial is designed for those who are completely new to Caliach Vision ERP and want to know how to use the free Demonstration Software.

Ledger Accounting

- Ledgers Layout and Integration

- Review Customer Account

- Receive Customer’s Payment

- General (Nomial) Ledger Postings

- Journals, Assets, Tax, etc.

- Month-End, Audits and Manager Functions

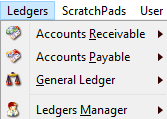

Caliach Vision has a full, three-ledger integrated accounting system built in which is turned on in the demonstration software and hence the Ledgers main menu is visible.

Accounts terminology varies from country to country and Caliach Vision uses the most widely understood names so the three ledgers are called Accounts Receivable, Accounts Payable and General Ledger. In most of the rest of the world these are also known as the Sales, Purchase and Nominal ledgers. The terms Caliach uses are arguably more correct and have the added advantage of distinguishing the ledgers from other sales and purchase activities on the system.

Ledgers Layout and Integration

The Accounts Receivable (Sales) Ledger covers accounting activities associated with customer accounts. The Accounts Payable (Purchase) Ledger is for supplier accounts. The General (Nominal) Ledger is the accounting of business trading and assets and liabilities. It is from the General Ledger that a Profit and Loss Statement and Balance Sheet derives. The General Ledger also contains an Asset Register.

Integration with the rest of the system is primarily with the Receivable and Payable ledgers. A customer entered under the Masters menu will automatically have an account in the Accounts Receivable and similarly suppliers will have accounts in the Accounts Payable ledger. Dispatches and Returns that create Invoices or Credit Notes will automatically post transactions to the Accounts Receivable and General Ledger. Integration between purchasing and the Accounts Payable is less automatic as invoices from suppliers are rarely available when the goods are received so a process of invoice verification is adopted in which a supplier’s invoice can be checked against purchase receipts. The sales agent commission system is fully integrated with the General Ledger.

The ledgers supports multiple foreign currencies and a VAT (sometimes known as GST or General Sales Tax) tax system and, Making Tax Digital (MTD) is available as an optional extra.

Review Customer Account

To review a customer’s account, operate the Ledgers→Accounts Receivable→Review Customer Account menu function. Click the Next arrow button twice and the customer ALW001’s account will be listed. The listing can be sorted by any of the columns by clicking on the heading. Typically it is most useful to sort by document date. Caliach Vision uses a universal transaction data structure for the accounts which means that all ledgers access the same internal transaction data file. This has the advantage that whenever you view account transactions in any of the ledgers, the list behaviour and functionality is the same.

At the top right of the window is a drop-down list of alternative list contents options. The default is This Year, so only recent transactions will be listed. Simply choose from the list to view an alternative. You can drill-down on a transaction by double-clicking on a line which generally will give you a detail window of the document associated with the transaction – in this case an Invoice or Credit Note. This drill-down is column sensitive however. In particular, double-clicking on the first M column will open any credit memo or will offer you the opportunity to create one. The second column, headed A, drill-down takes you to the Allocation table for transactions on the account. This describes the relationships between payments and invoices. Finally, scroll the list horizontally to the right until the Contra a/c column is visible. The contra account is the general ledger account to which, in this case, the sales income has been posted. If it was a payment it would be a bank account. Double-click in this column and you will open a transaction review window for that account.

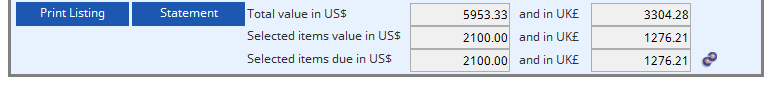

If you click on the icon button at the bottom right of the review window, the totals section at the bottom of the window expands to show selected values. Select a number of lines in the list to see the totals change to reflect your selection. Right-click on any of the values to use them in the calculator. When an account is a foreign currency account, both that currency and local values are shown, as illustrated by figure 5.3.

Now close all the windows you have open for this part of the demonstration.

Receive Customer’s Payment

To complete the business cycle we need to record a payment from our new customer for the goods we dispatched. Let us assume the customer has sent us a cheque in the mail.

Operate the Ledgers→Accounts Receivable→Receipts from the Customers menu function. This will open the Customer Payments window which is almost exactly the same as the Refunds to Customers in the A/R and the Payments to Suppliers and Refunds or Cancel Payments in the A/P. Operate the Next icon button as before to load the new customer account AAA000 and the single invoice will be listed. There are many things you can do on this window to accommodate special circumstances, but for now we will simply record the full payment of the invoice. To do that, click on the Pay selected checkbox at the bottom of the window. This will automatically put the value of the invoice into the payment value box. You can then add a document reference which typically would be the folio number of the bank paying-in book. This will be useful later when doing a bank reconciliation. You also have the option to enter a comment. To complete the process, click on the Post Transaction button. You will be asked to confirm your decision as a safeguard to allow you to check that you have entered the correct information.

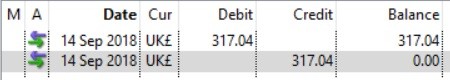

When the processing completes, the payment line will appear in the list with the allocation recorded with icons showing in the A column. Here, we are looking at the customer account but when posting, additional transactions are created in associated general ledger accounts such as the bank and debtor control. This is typical of Caliach Vision Ledgers in that a single user activity will post immediately associated G/L transactions. This concurrent posting approach means that the state of the business can be assessed in real time.

We have now explored the Accounts Receivable ledger and you may want to explore more of the A/R and the A/P ledgers where the functionality is much the same. The main difference is that with supplier accounts, there is no direct link between supplier’s invoices and purchases in the way that there is between customer accounts and sales dispatches. Invoices from suppliers are directly recorded with a voluntary invoice verification process to check that you are being charged appropriately and also to keep part costs up to date. Now we will move on to explore the General Ledger.

General (Nominal) Ledger Postings

The General Ledger contains the business internal accounts while the other ledgers keep track of the external debtor and creditor accounts. Every transactional activity in the A/R or A/P automatically creates appropriate transactions in the general ledger. For example, when an invoice is created, at least one G/L sales account is credited with a balancing debit to the debtor control account and a credit to the tax account. When the invoice is paid by the customer, the debtor control account is credited and the bank account debited. All general ledger postings involve at least two transactions that add up to zero with a debit being a positive number and a credit negative by convention. When running normally, this process will automatically keep the accounts in balance.

General Ledger accounts are either Trading or Asset accounts. Trading accounts record the income and expenditure over a period, typically a month. Asset accounts show the value of assets or liabilities at any particular point in time. The accumulation of activity in trading accounts over a month will show the profit or loss made by the business in that time. The state of the asset accounts at the end of the month is referred to as the Balance Sheet and from this you can see the net worth of the business.

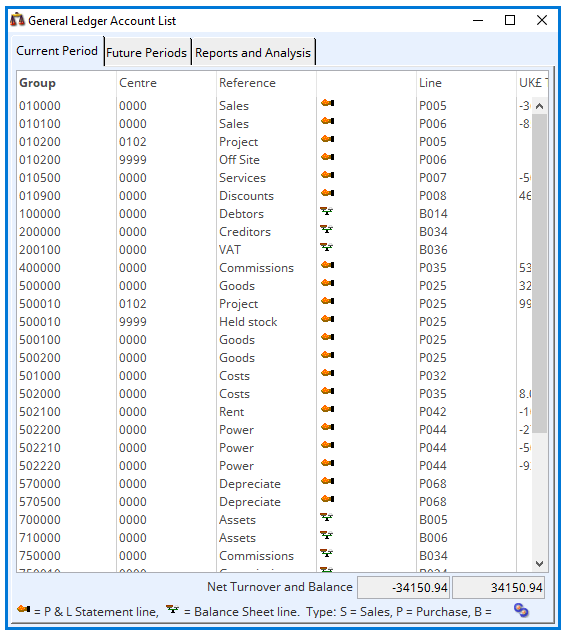

The best instant view of the current G/L status is by operation of the Ledgers→General Ledger – Review Account List. The first tab pane lists the current state of the accounts in the current G/L accounting period. The second tab pane shows the same accounts but includes any future period transactions. The ledgers operate on a period calendar, typically monthly. All transactions are posted to a specific period and, at any one time, each ledger sits in a particular period so that transactions posted in a ledger, by default, are posted to the ledger’s current period. All ledgers are moved on to the next period by the month-end procedure. Ledgers need not be in the same period but you can only perform a month-end on the G/L if both the A/R and A/P have been, or are being, closed for that period. In practice then, the A/R (Sales) for June can be closed with a month-end on 1st July. The A/P however can remain open for June until, say, 15th July, while supplier invoices that relate to June activity trickle in. The G/L can be closed any time thereafter when you are ready. During such out-of-phase periods and at any other time, you can also post transactions into future periods. For example, with the G/L still in June, you can post a journal for wages in July, or August, etc.. There is even a manager function to move transaction sets from one period into another as long as these periods remain open in the G/L.

You will see in the list that accounts are either Trading (P & L – Profit and Loss) accounts or Asset (Balance Sheet) accounts. These respectively have a turnover value or a balance value. Trading accounts represent the income and expenditure over a period of time (current period or year to date). Asset accounts represent the value of assets or liabilities at a single point in time such as the state of a bank account. If the G/L is in balance, the sum of the trading account turnovers should be equal and opposite to the sum of asset balances so that they add up to zero.

Up until now you have seen transaction lists with debits and credits shown in separate columns with the numbers always positive, however within the system, they are actually stored as positive numbers when debits and negative when credits. This is a computerised accounting convention that Caliach Vision adopts. With the G/L Account List the raw numeric turnover and balance values are shown and this can sometimes confuse the uninitiated. At first glance this seems a very un-intuitive approach as most people are used to seeing accounting reports and presentations with all positive numbers but where your understanding of the sense is derived from the account description. Sales 1,000, costs 800, profit 200 (1000 – 800) makes total sense by virtue of the use and meaning of the words. Computers however, place no value in the meaning of words nor can they deride any alternate logic from the use of words. Computers need to simply add up the numbers without any reference to what the account descriptions you give them may imply. By convention, sales are credits to trading activity and costs are debits so the example above would be Sales -1000, costs 800, profit -200. Note that in trading terms, profit is a credit. On the balance sheet side of the accounts, assets are debits and liabilities are credits so having money in the bank will show up as a positive number while a loan will be negative. This is because the balance sheet is intuitive but the trading side is not. If it were otherwise, we would have to make a credit positive on trading accounts and negative on balance sheet accounts which would make things very confusing.

For most manufacturing businesses, a good portion of G/L transactions derive automatically from the A/R and A/P activity such as invoicing sales and posting supplier invoices. Internal activity such as payroll, asset depreciation, petty cash, etc. take place in the G/L exclusively.

Journals, Assets, Tax, etc.

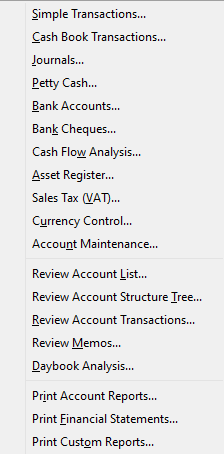

On the Ledgers→General Ledger Menu, you will find a number of familiar accounting activities.

Simple Transactions are one-to-one account transfers, for example, a movement from one bank account to another .

Cash Book Transaction are multiple G/L postings that can involve sales tax (VAT or GST) in which bank or cash payments are made. This mechanism can be usefully used where suppliers are infrequently used and not worth processing in the A/P.

Journals are complex multi-transaction postings involving any G/L accounts. They are used for such things as payroll and adjustments before month-end. They can also be recurring or reversing.

Petty Cash is a feature that allows you to keep an encapsulated record of activity in a cash account. As it’s name implies, it is typically useful for petty cash but it is also useful for employee expense accounts.

Bank Accounts can, in this area, be reviewed and reconciled to bank statements. Bank reconciliation is your ultimate mechanism of error detection.

Bank Cheques is a suite of activities associated with automated cheque printing and/or electronic payments, such as the UK’s BACS.

Cash Flow Analysis looks at the state of bank accounts and any pending A/R or A/P cash movements. You can set up forecast movements and they can be recurring to yield you a full and accurate cash flow forecast.

The Asset Register is a database of business capital assets such as plant and machinery, buildings, vehicles and office equipment, etc.. You can set depreciation to be automatically posted at G/L month-end.

Sales Tax (VAT or GST) is the area in which tax is analysed and returns to tax authorities computed. The system can handle multiple compound tax systems such as found in countries such as Canada.

Currency Control provides access to a currency database and contains a number of re-value functions.

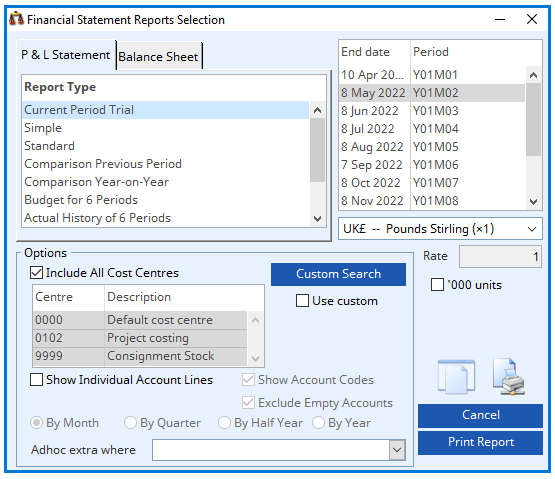

The final area worth mentioning here is the Print Financial Statements menu function ?. This is where you can print Profit and Loss (Income) Statements and Balance Sheets. Each G/L account must be assigned to a Profit and Loss or Balance Sheet report line. You may have seen the codes in the Review Account List in figure 5.6 above. The report layout and headings are maintained in Ledgers→Ledger Manager→Report Layouts.

At G/L month-end, each account in which transaction activity has been recorded is closed for the period and a history record created in which the net turnover or closing balance is recorded. This history is then used to provide both trading and balance reports. The Current Trial reports are special in that they ‘construct’ history for the current period from transactions. That is why you can only run that report for the current period. All others can be run for any closed G/L period.

The cost centre for accounts can be fully exploited here to permit views of different parts of the business.

Month-End, Audits and Manager Functions

The Ledger Manager menu contains functions that are needed when setting up the system and those special periodic activities that need special attention.

Control Settings is the area you use to set up a number of specific accounts so that automated transactions can be made, for example the debtor control account. There are other controls and options that allow the system to meet many accounting circumstances.

The system needs a Period Calendar that identifies month-ends and allows you to set a simple description for each period for easy identification.

General ledger accounts all belong to a Cost Centre. You can setup many cost centres that represent different divisions of the business which then makes it easy to view division performance individually.

Report Layouts have been mentioned earlier. It is here that you setup your Profit and Loss and Balance Sheet statement designs. There is also a whole financial custom report design environment to meet specific Vision customer requirements.

The Audit Trail is effectively a listing of transactions from all ledgers. It can be used to view a complete sequence of transactions created by a single process such as when creating an invoice. There are numerous reports that can be run and there is also an ability to correct certain non-critical data errors such as date and comment.

The Change Transaction Period feature has a similar listing to the Audit Trail. Because Caliach Vision ledgers are only sensitive to period, we have provided a mechanism here for moving sets of transactions from one open period to another. Dates may be important to you but they are simply cosmetic to the system so if you date a supplier invoice 15th June as that is the invoice date, it may well apply to May’s costs so you would post it into May’s period.

Subsidiary Export and Subsidiary Consolidation are a pair of functions that enable you to handle a parent-subsidiary company structure. You may have many subsidiary companies all running their own independent accounts and at the end of each G/L period, each subsidiary would export their results and send this to the parent company who would then import the results to provide consolidated group accounts. The system also handles international situations using multiple cross-currencies.

Month Period-End and Year Period-End functions are activities you run when everyone else is off the system. Month-end is more critical as it is non-reversible and locks the account results into history. Month-end on each of the three ledgers can be done independently but the G/L month-end can only be performed for a period after, or along with, the A/P and A/R. Once a G/L period has been closed, no transactions can be posted to that period but this rule has one exception which is designed to accommodate late adjustments by auditors. You can post a retrospective journal as long as you have not performed a year-end which encompasses the period into which you are posting. In this way, for the final month of your financial year, you can close the month as normal and carry on into further periods, wait for the auditors to inspect your accounts, post a retrospective journal to accommodate their findings and finally run a year-end. The year-end simply adjusts year-to-date values and resets the first period of your current year for transaction listing purposes. It has no transactional effect on the accounts.

That completes this section on ledgers in this tutorial. Most topics have been covered only briefly but again, this is only designed to give you an overview on the capabilities of this integrated accounting system in Caliach Vision.

We are now going to return to the manufacturing functionality for the next part of the tutorial and explore Material Requirements Planning.